Resilience in the face of monstrous swings in the market, have shown to benefit long-term investors.

We have experienced quite a fascinating year in the markets. We saw a market crash (referring to a decline of more than 20%) at the start of the pandemic, a full recovery, and currently markets are at an all-time high, both locally and globally. This would of course lead to an emotional roller-coaster ride for investors too. Nobody wants to lose money, which you worked hard for, and even less so when you are approaching retirement.

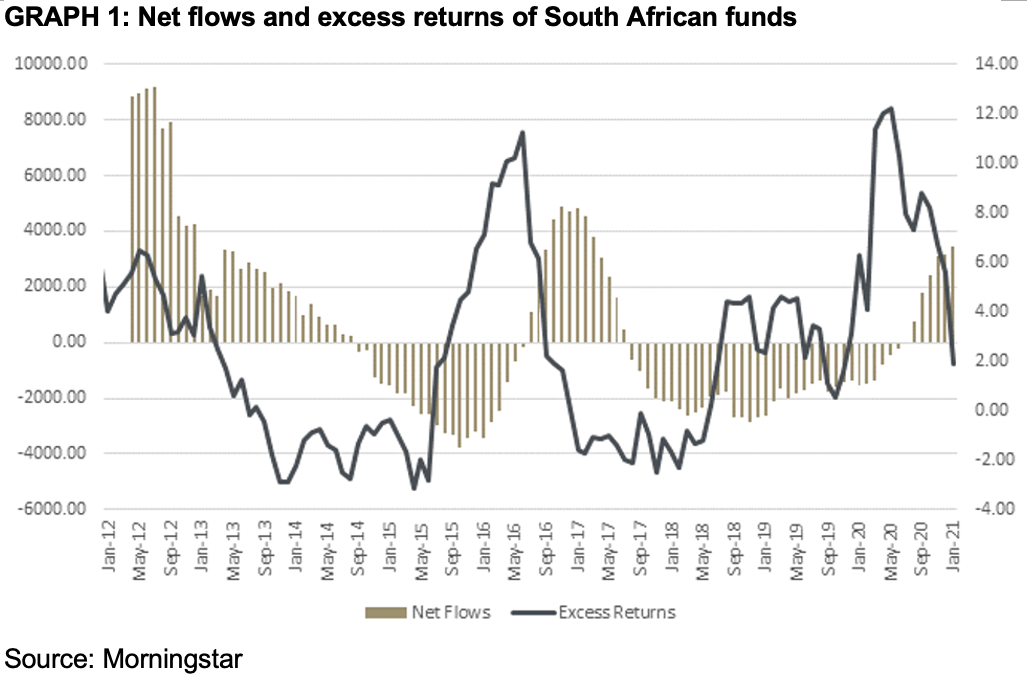

The fascinating thing about human behaviour is that we mostly get it wrong once we start trying to ‘time’ the market. Graph 1 illustrates the net flows in and out of funds, compared with the returns of those funds. We typically only start investing once the funds have reached their peak and the return is already starting to decline. And once funds have already experienced a negative return, investors typically withdraw, once the fund is starting to recover, realising our losses at the worst possible moment.

With most things in life, the sure way to success is acting. If you want to lose weight – start eating healthier and start getting active! If you want to run a marathon – start with a running program. Learning a new language – enrol for a course or find a tutor. When it comes to managing your investment portfolio, however, in many cases the opposite is true.

The reality is that the market will always move in cycles. Some cycles are more volatile than others, but making emotional decisions at the wrong time, or trying to time the market, can have a detrimental effect on your investment portfolio.

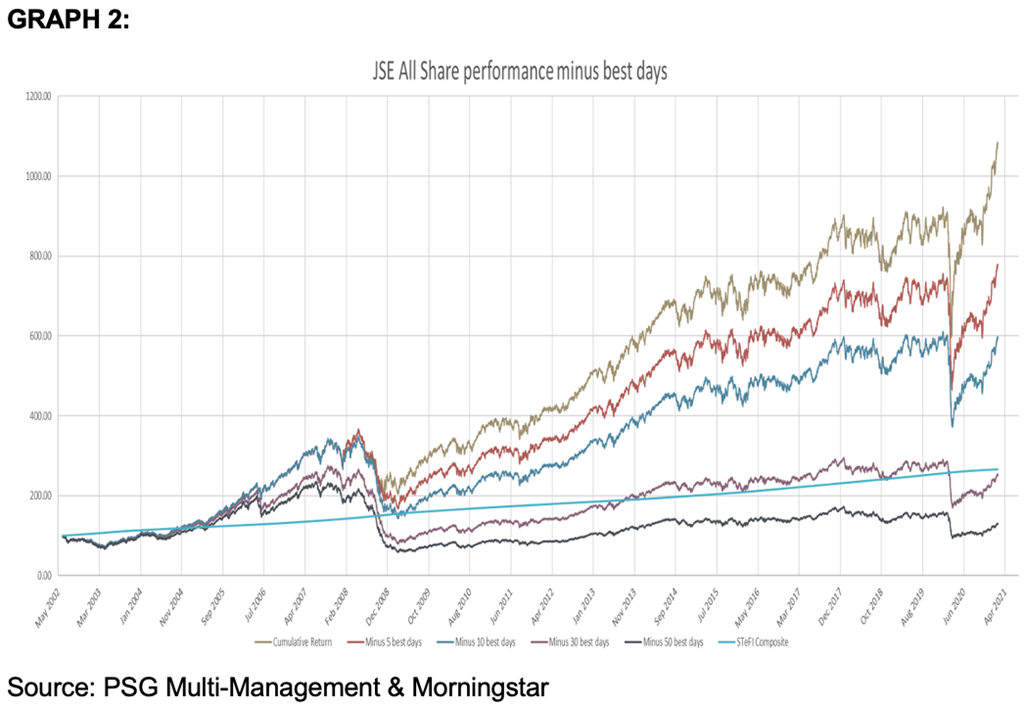

Graph 2 analyses market performance since March 2002. It illustrates the effect of having remained invested for the entire period, compared to missing out on the best 5, 10, 30 and 50 days of market performance, and being invested in cash. Missing out on 50 days in the market over a period of 20 years does not feel like much, does it? But the outcomes are quite different. The difference from missing out on a few days of market performance, can make the difference between being able to retire, or not.

The compounding effect of a few positive days in the market – and timing them wrong, makes all the difference when it comes to investing. So, a few tips:

- Don’t try to time the market.

- Make sure you have an investment strategy in place – and then stick to it.

- Ensure you are invested appropriately for your timeline, e.g., retirement.

- Ensure you have a diversified portfolio – missing out on the best days has a similar effect to being invested in cash (light blue line in the graph).

Outsource the decision making by involving a wealth adviser, so you will not have to make the difficult decisions when markets are volatile. We are only human and would want to react. Having an objective opinion will make sitting on your hands easier in turbulent times.

Elke Brink is a wealth advisor at PSG Wealth.

Publications

Publications

Partners

Partners