- Mustek grew revenue 12.5% to R4.19 billion in six month to end December 2021.

- The company expects the demand for tech products to remain "buoyant" despite chip shortages.

- The chip shortage is expected to remain in place until 2023.

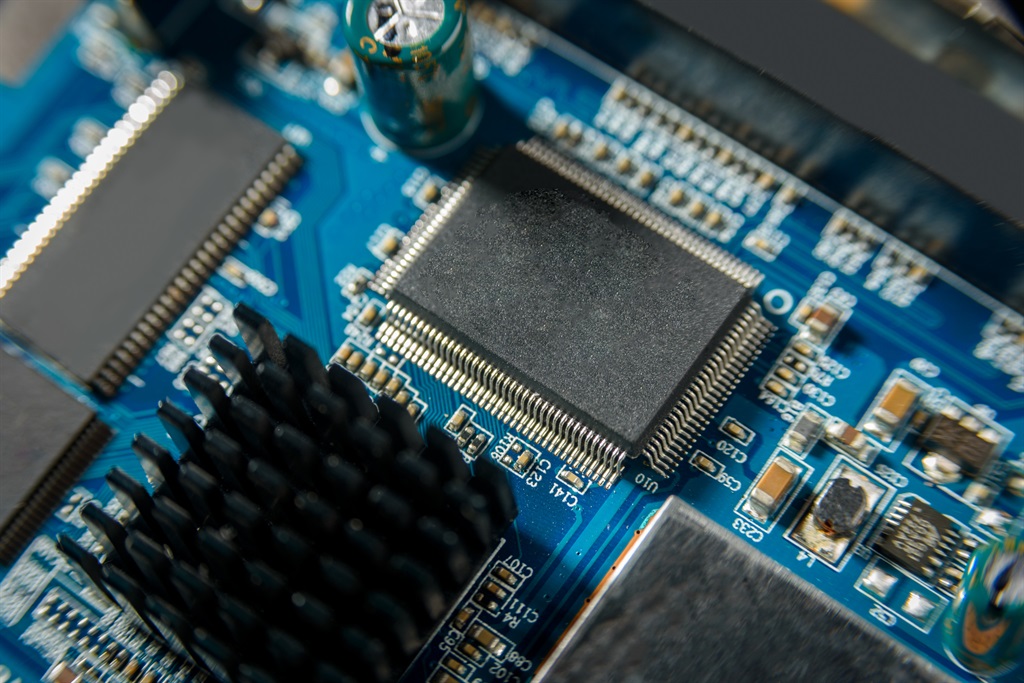

Technology components supplier Mustek has weathered the operating challenges posed by global chip shortages, posting improved financial results in the six months to end December 2021.

The company said on Wednesday its gross profit margin increased to 16.2% to R676.3 million, because of increased demand for tech products amid worldwide supply shortages. Mustek assembles and distributes a range of information and communication technology products.

"The supply shortages created strong pricing power and we expect this situation to continue well into 2023," the company said, adding that the weaker rand-dollar exchange rate also contributed to the higher gross profit margin.

Revenue was up 12.5% to R4.19 billion compared to R3.72 billion in the corresponding six months of 2020.

The computer component supply chain remains constrained globally, well into 2023.

The global chip shortage - in part exacerbated by a demand for tech products after the start of the Covid-19 pandemic in 2020 - has hit a number of sectors, including the car-manufacturing sector.

Although supply chain constraints have caused longer lead times for companies, Mustek says it expects current supply chain dynamics to have a positive effect on the firm.

Mustek has forecast that the demand will remain "buoyant" despite the chip shortage challenges and the company is evaluating additional offerings to better utilise its infrastructure and benefit from economies of scale.

"The device market size is increasing which bodes well for future replacement cycles. In addition, this is driving the demand for new infrastructure to support these devices. This is likely to accelerate the growth of the ICT industry over the coming years," it said.

Mustek’s headline earnings per share was 17.3% higher at 237.09 cents, compared to 202.11 cents in 2020, while basic earnings per share was 17.9% higher at 232.72 from 197.34 cents.

The company share price bumped up 3.3% in morning trade to hit R15.19, having dipped to R14.85 earlier in the morning session.

Publications

Publications

Partners

Partners