While a record R1.6 trillion are now held as retail savings deposits, Michael Kruger explains why cash the least likely asset class to deliver significant real return.

- For more financial news, go to the News24 Business front page.

A record amount of R1.6 trillion is currently held in South African bank accounts as retail savings deposits. This is a staggering amount of money which is currently conservatively invested. In many ways, this movement of funds reflects the significant uncertainties faced by investors, both in South Africa and globally.

Many investors are sitting in cash with the hope that an attractive entry point into markets may be on the horizon. Unfortunately, as history has taught us, trying to time markets can mostly be regarded as a fool’s errand. Investors are often better off being guided by their willingness and ability to take risk when making investment decisions, rather than the current news flow or the latest geopolitical event.

Where does cash currently stack up as an investment in South Africa?

Return expectations from cash are largely a function of the prevailing level of interest rates. The South African Reserve Bank’s (SARB) primary monetary policy objective is price stability and secondly to enable balanced and sustainable growth. The SARB will, therefore, adjust the level of interest rates according to their current and future expectations for inflation, as well as their outlook for the local economy.

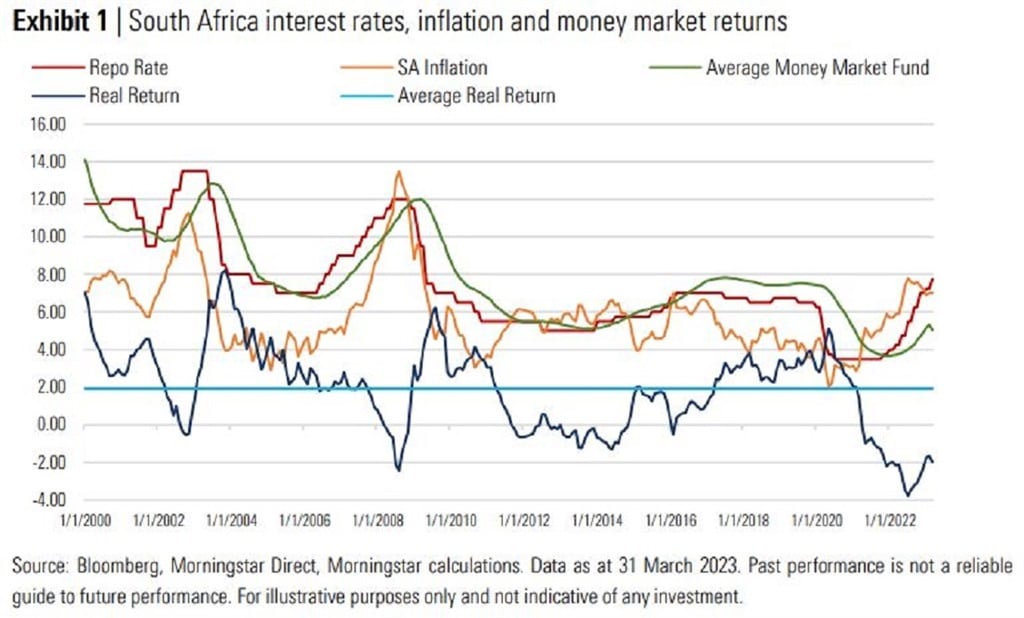

During 2020, following the discovery of Covid-19 (which resulted in many economies initiating hard lockdowns), the SARB cut interest rates significantly to provide support to the SA economy. This resulted in the repo rate being cut to 3.5%, its lowest level in decades. This severely impacted the return available from cash, particularly in real terms (after inflation), which can be demonstrated by the below chart:

As economies and borders reopened, inflationary pressures started to build, which led to many central banks having to raise interest rates to bring down stubbornly high inflation. South Africa was no different in this regard, with the SARB raising interest rates by a cumulative amount of 4.25% since November 2021. This has brought the repo rate to 7.75%, a positive leading indicator for the future return prospects from money market funds, as indicated by the close correlation between the repo rate and money market returns in the chart above.

Unfortunately, despite inflation moderating from its mid-2022 peak, it remains stubbornly high, with the latest print to the end of February 2023 coming in at a year-on-year figure of 7%. This is significantly above the SARB’s target band of between 3% and 6% and means that conservative investments in cash are unlikely to reach the historic long-term real return provided by these investments of 2% in the short-term.

Why is cash not a great long-term investment proposition?

Cash is the perfect asset class to allocate to for near-term expenses or an emergency fund. This is largely due to the underlying characteristics of cash when compared to other asset classes such as equities, bonds or listed property. Investors in cash have the benefit of a smooth and stable return profile with very little volatility – all essential ingredients for those investors with short-term funding needs.

Over the long-term, however, cash can be a drag on the real return prospects of an investment portfolio. For those investors who are seeking long-term capital growth, it is essential to have sufficient exposure to growth assets such as equities, as well as exposure to bonds, which brings a level of ballast and stability to a portfolio.

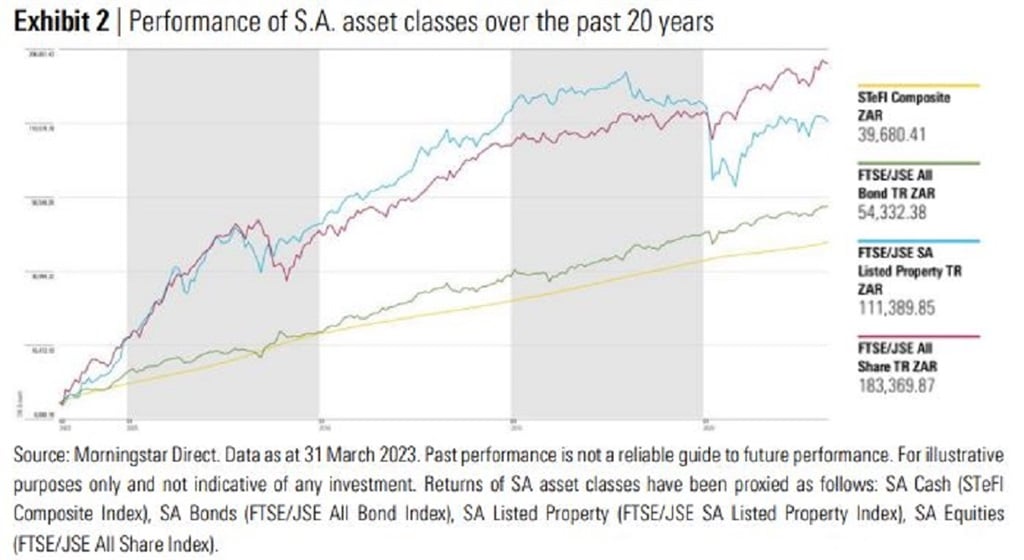

The differing characteristics of the various asset classes are apparent from the below chart, which shows the performance of SA asset classes over the past 20 years.

What is evident from the above chart is that cash provides a smooth and stable return profile. However, over the long term, investors that are willing to stomach the additional volatility of investing in growth assets, are rewarded with higher returns.

Investing in growth assets can be a bumpy road, as evidenced by the setback to the returns of both equities and listed property during the global financial crisis in 2007/08 and the Covid19 induced market drawdown in early 2020. However, those investors that remained invested during these two market events were rewarded with superior real returns over the long-term.

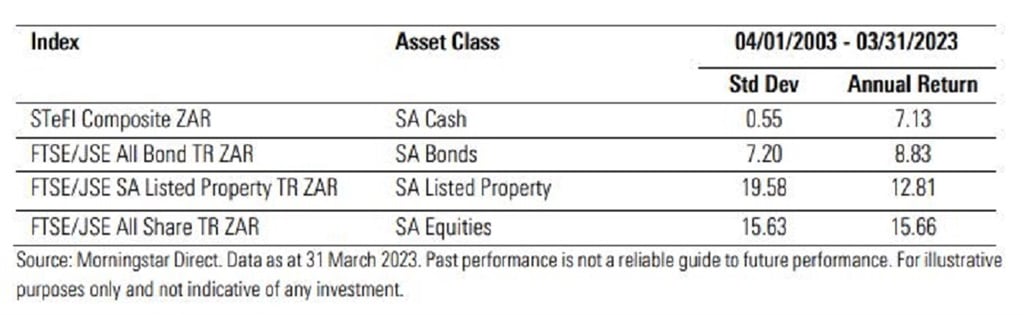

Representing the performance of SA asset classes in a slightly different format, the below table shows the annualised performance of these asset classes, along with the standard deviation of returns (a popular measurement of risk) for each:

It is clear from the table that cash is the least volatile asset class when proxied for risk using a measure such as standard deviation. However, it is also the least likely asset class to deliver significant real returns, and investors with the willingness and ability to take on risk should consider allocations to other asset classes including equities, bonds, and listed property. This provides investors with the best opportunity to reach their financial goals and avoid the degrading impact that inflation has on growing real wealth.

So, what role should cash play in an investment portfolio?

As multi-asset investors, Morningstar considers the prospects for all asset classes when building client portfolios. This includes the asset classes mentioned above such as equities, bonds, listed property and cash, both in South Africa and in global markets.

In our view, cash plays an essential part in making sure that investors achieve their financial goals. Cash brings an element of capital preservation to a portfolio, particularly in the event of significant market volatility in equity or bond markets. It also provides an element of optionality, which fund managers can hold as dry powder, to deploy if markets move away from their underlying intrinsic value.

For all its benefits, however, cash should not be regarded as a method to maintain or grow real wealth. It should also not be used as a hiding place for those investors that are fearful of current market conditions due to negative news headlines or geopolitical events.

History tells us that allocations to growth assets are the best method of preserving and growing real wealth over time and that patient investors that are focused on time in the market rather than timing the market will be rewarded with the best investment outcomes over the long-term.

Michael Kruger is a senior investment analyst at Morningstar Investment Management SA.

News24 encourages freedom of speech and the expression of diverse views. The views of columnists published on News24 are therefore their own and do not necessarily represent the views of News24.

Publications

Publications

Partners

Partners