Budgeting is one of the most effective ways of managing your money. Not knowing if your money will take you to the end of each month is stressful. While everyone’s circumstances are different, there is no doubt about the relief a financial safety net brings. Budgeting will not only help you stay afloat, but also ensure you have something set aside for when you need it most.

If you're new to spending money according to a budget, it might seem like too much effort at first. You may even feel that it could be too restrictive. The reality is that you have far more to gain from working with a budget than without one. Being in control of your monthly finances, especially during times like these, can be an incredibly rewarding feeling. Here are some of the benefits you could experience by following a budget:

- Budgeting prevents you from overspending. It puts you in control of your money so that you have something to show for the money you spend.

- It helps you see how you can realistically reach a financial goal, no matter how small it is.

- Working out a budget means you know exactly how much you allocate to all your different needs. It gives you some certainty in managing your money to get you through the month.

- It can help you see where you can be flexible with how you spend your money. If you decide to spend more on one need and less on another as the month goes by, that's fine, as long as you don't cut down on saving.

- It helps you save. As you get used to working with a budget, you could start seeing the amount you are able to save every month increase.

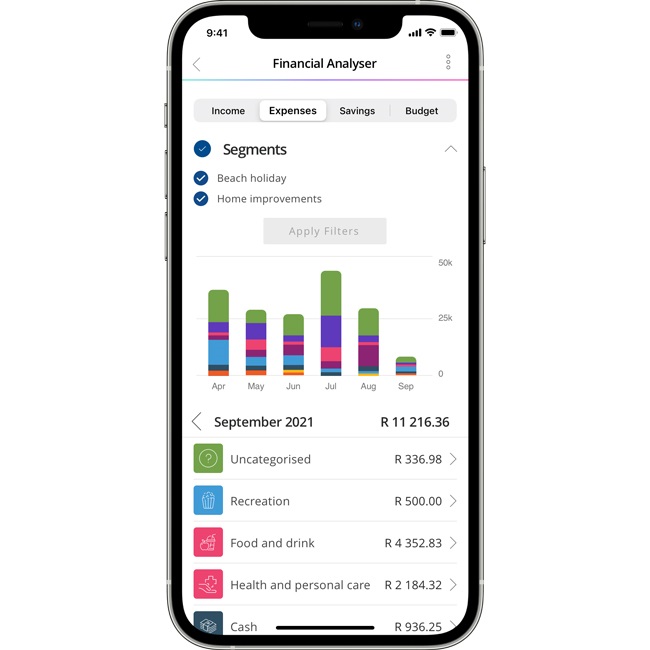

Budgeting doesn't have to be complicated and time-consuming. Using advanced analytics and data processing, Discovery Bank’s Vitality Money Financial Analyser gives personalised insights into monthly income, savings and spending.

It enables Discovery Bank clients to automatically place client’s expenses into more than 166 pre-set categories and gives clients the power to personalise and re-order categories for anything from holidays to home improvements, with a predictive search functionality.

With unique insights and AI driven alerts on spending trends in each category over time, clients are kept informed on what they are saving by following and keeping to their budgets, and they can set limits in categories to prevent overspending and so earn more rewards for managing their money well, including 5 000 Vitality Money points for engaging with Vitality Money Financial Analyser – that also links to Smart Vault to store important receipts or documents related to important transactions.

About 65% of people don’t know what they spend their money on in a month and more than half underestimate how much they spend, which means most people are not thinking through their financial decisions.

“Vitality Money creates an awareness of financial behaviours and puts people in a position to manage their money well. Part of managing money well, is knowing exactly what you’re spending money on, where you are possibly overspending and following a set budget. The newly launched Vitality Money Financial Analyser gives clients a real-time view of their finances and trends and intelligent alerts to help them manage their spending - one step closer to achieving their financial goals.,” says Akash Dowra, head of client insights at Discovery Bank.

This post and content is sponsored, written and provided by Discovery Bank.

Publications

Publications

Partners

Partners