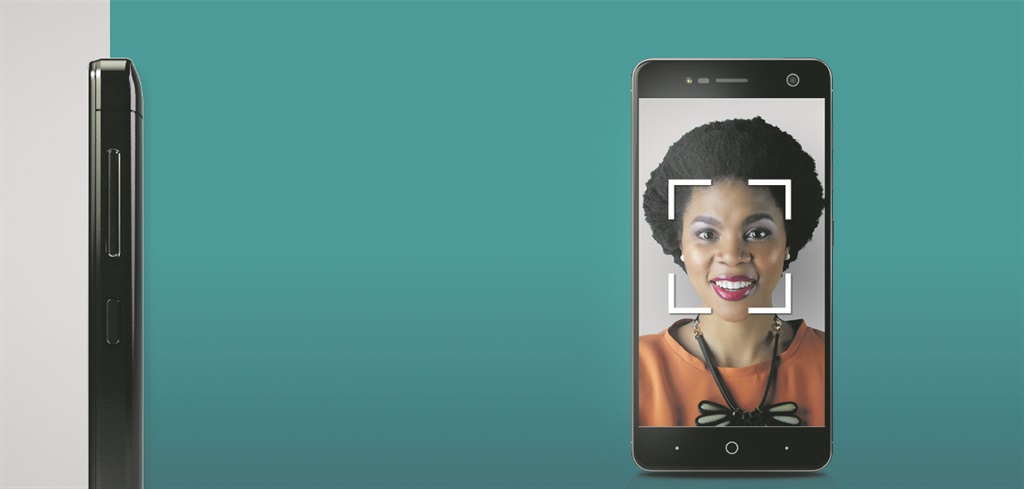

Tapping into the mobile-first generation, FNB recently announced that customers can open individual or business accounts directly on its smartphone app within minutes by uploading a selfie.

Identity verification is completed through a tie-in with the department of home affairs, a process that took around 18 months to pull off. The app also uses the GPS functionality on a smartphone to geo-locate you as a way to verify your address. It’s useful for those who don’t have bills under their name for the physical proof of address required at other banks.

Opening an account with a selfie means no queues or paperwork. All you need is the app and an email address. Everything is done digitally within a few minutes if you’re a South African citizen with a valid ID number.

About a year ago, FNB zero-rated its apps across all mobile networks in South Africa. Whether you are on Vodacom, MTN, Cell C or Telkom Mobile, you can bank from the app without incurring data costs, which could be a drawcard for a lot people.

One of the other features that tech-savvy individuals and customers can look forward to is the ability to pay for stuff using wearable tech. The bank is in talks with Fitbit and Garmin to bring payments to these platforms with a simple swipe of the wrist.

Grabbing a smoothie after a morning run this way sounds convenient, but if you have an Apple Watch, you may have to wait as there are currently no plans to support the platform. FNB is working on letting customers pay merchants by scanning a QR code, similar to the way Zapper works.

Its latest innovation comes just one month after the bank announced a mobile-first bank account called eWallet eXtra, which has no banking fees and is aimed at the “unbanked”.

Users who have feature phones are able to open an account with just a name, surname and ID number directly from their handsets. No Fica documents are required. The account will allow deposits of a maximum of R14 000 a month; let you pay individuals, bills, or clothing accounts; buy electricity or data; withdraw cash from tills at supermarkets; and view transactional history. It does not support debit orders.

Whether you’re a smartphone or feature phone owner, FNB is a bank worth considering.

Publications

Publications

Partners

Partners