We’re already four months into 2018 and for most of us, the stress of Januworry is not a thing of the past.

With imminent tax hikes, keeping food in the fridge and loo paper in the bathroom is challenge enough and the thought of saving is probably as foreign as spreading caviar on your toast.

But it can be done. It can! And I know because I discovered a plan that makes it possible. It all started last year when a friend told me, “I found this 52-week savings programme and I think we should all try it.”

READ MORE: How to find a side hustle to boost your income

I needed no persuasion. In 2016 we’d gone on a girls’ trip to Thailand and the last-minute rush to save was a nightmare.

When I got back I resolved to be that person – the one who saves for something. It needs discipline and dedication but it can be done.

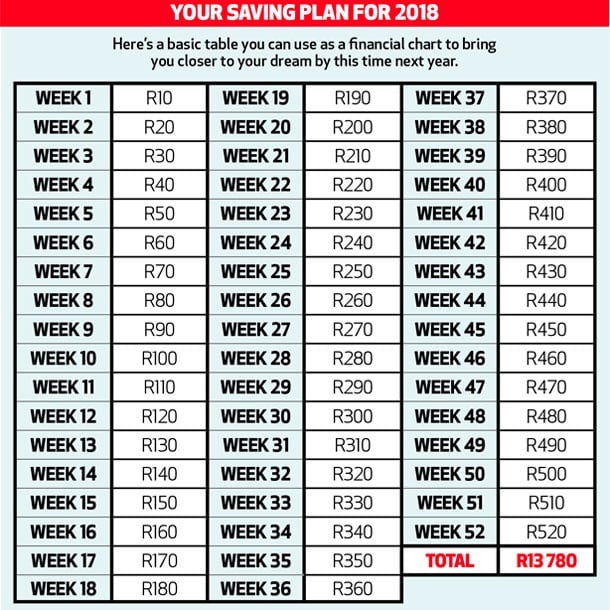

The 52-week savings plan is based on the premise that every week of the year you save some money in order to accumulate a lump sum at the end of the year that you can use for whatever you want: a holiday, honeymoon or new TV or to have cash in hand to buy your kids’ school clothes and stationery and pay their school fees.

Stick to the plan and by the end of the year you’ll have accumulated R13 780. You start off by saving R10 in the first week, then you add R10 to each week’s savings amount – or to make things a bit easier, simply multiply R10 by the week you’re in.

So in week one you save R10, in week two you save R20, in week three you save R30 and so on until you reach week 52, when you save R520.

Each month I combined the amounts I’d saved in the four- (or five-) week period and deposited it into a 32-day savings account, which helped as it took away the temptation to withdraw money on a whim.

The great thing about this savings plan is that it’s adaptable and can be switched up to suit your financial needs. For example, during the earlier months you could choose to double up the amounts if you want to, because they aren’t that big – this would result in even more money being saved by the end of your 52 weeks.

Here's why I did it

I’m budget-conscious and money savvy.

In fact, my housemate often teases me about the way I’m able to weave magic out of the tiniest budget.

I’ve been bitten by the travel bug but seeing the world comes with a hefty price tag. A few friends and I are planning a trip to America later this year so I thought it a good idea to get the savings ball rolling. It’s quite a pricey trip but, as I’d started saving last year already, I thought it would put me in a good financial position.

I’ve just finished paying off my car so now I can increase my monthly savings by putting the monthly instalment amount towards the trip.

The challenges

Savings and finances vary from person to person. For me, most of my monthly expenditure goes toward paying my bond, monthly costs such as groceries, water and electricity and, until recently, my car.

Life is unpredictable, and sometimes unforeseen circumstances can throw a spanner in the works.

In May last year my car was broken into and this caused an unexpected financial burden. So I skipped my savings for the month of May, in which I would’ve accumulated R740 (week 17 to week 20).

In June I needed to book flights to the Eastern Cape, so again I skipped R900 (week 21 to week 24) for that month.

The pitfalls

Before embarking on the 52-week plan, I already had R2 008 in my savings account which I thought was great in that it gave me leeway to skip the earlier months if I needed to.

It made me consider not depositing money into my savings account during the early months, but fortunately I didn’t fall into that trap.

Yet what I wish I’d done was to boost my saving when I returned to the plan after falling off the wagon. I skipped May and June so instead of saving larger amounts from July onwards I fell back and saved the May amount in July and the June amount in August.

This set me back by a whole two months and caused me to lose out on maximising the amounts I could’ve saved. And, by picking up only where I left off with the missed May and June amounts, by the time I reached week 52 I hadn’t made the big payments scheduled for the last two months.

Still, in order to make up for the loss, I’ve decided to double up the savings amounts during the first five months of 2018 to increase my total savings by the time my trip comes around at the end of the year.

READ MORE: Travel insurance: What you need to know

The result

At the end of the 52 weeks I’d saved a total of R11 900, including the R2 008 I had before starting the plan. This means that on the savings plan alone, I saved R9 900. I had a deficit of R3 880 because of falling behind on the saving for May and June.

Although I didn’t manage to save the full R13 780, I’m proud of the strides I made and that I managed to save a substantial amount to get me well on my way to making my trip at the end of the year a reality.

Would I ever do it again?

Definitely! Even though I haven’t been able to access or spend my savings during the holiday season, the comfort of knowing I’ll be able to pay for a dream trip is a great feeling.

The savings plan also gave me a sense of nostalgia. When I was younger I’d get money on my birthday or for doing odd jobs and chores and I’d save it for a rainy day or for something I really wanted.

It’s the same principle now and, just as it did back then, the fact that I was able to successfully save a substantial amount gave me a sense of fulfilment and joy. It also helps make being a grown-up a little easier.

Publications

Publications

Partners

Partners