South Africa’s economy grew by 2% in 2022 to R4.60 trillion from R4.58 trillion in 2019. This is a 0.3% increase that lags the 3.5% growth in the country’s 60.6 million population over the same period.

Data released by Stats SA said on Tuesday five keys contributed to growth included:

- Finance, real estate and business services expanded by R87 billion to R1 408 billion;

- Manufacturing expanded by R70 billion to R800 billion;

- Trade, catering and accommodation expanded by R52 billion to R803 billion;

- Transport, storage and communication expanded by R51 billion to R449 billion;

- Personal services expanded by R33 billion to R968 billion.

READ: South Africa will only see growth of 0.3% this year, says Sarb

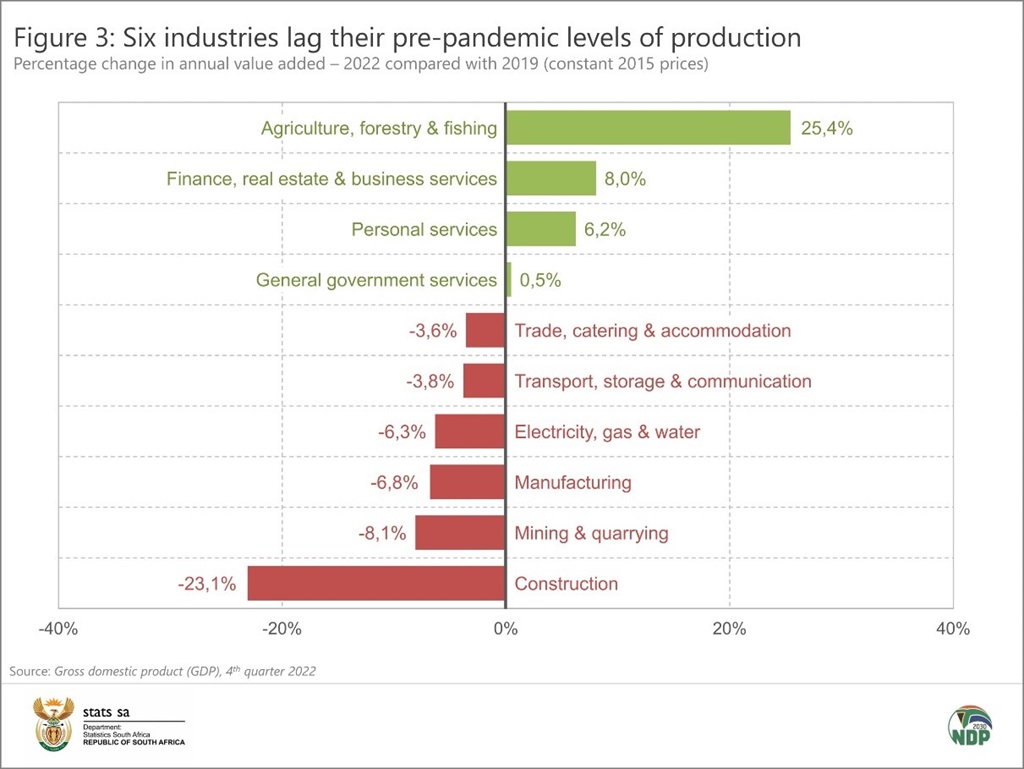

Six industries were yet to recover to pre-pandemic levels, including the mining industry, which was the main drag on annual economic growth for 2022. The sector declined by 7% year on year. The construction sector was in the worst shape when compared to pre-pandemic levels. it shrunk by 23.1% after a sixth consecutive annual decline in 2022.

Former Statistician-General Dr Pali Lehohla says GDP per capita has been on a downward trajectory and not because of excessive population growth.

“The mantra for South Africa has been there are valid macro-economic fundamentals and they are solid. When you have an unemployment rate of around 33% when does that make fundamentals valid?

Despite headwinds faced by many households on the back of the increased cost of living, including high inflation levels and interest rates, household consumption expenditure was resilient after increasing by 2.6% and contributed 1.7 percentage points to growth for the year.

However, capital investment remained in the single digits. It saw an annual growth rate of 4.7%, pointing to a lingering weak appetite to investment brought on by load shedding, concerns about policy and increased crime levels in the country.

“Despite all the investment summits since 2018, gross capital formation [capital investment] has been in the doldrums. There is no evidence that there is anything happening that can get the economy out of trouble because gross capital formation is one of the core drivers of growth when it is done [properly]. At the moment, it is happening at a very pedestrian level and there’s really nothing to hope for with this casualty.”

Last quarter growth of 2022

Key sectors of the economy, including finance, agriculture, mining and manufacturing, weighed on the country’s economic growth in the last three months of 2022. The economy contracted by 1.3% in the fourth quarter after growing by a revised 1.8% in the quarter before.

READ: Lights Out | Load shedding worse than Covid-19 pandemic – business owner

South Africa’s economy was hit by load shedding that has stymied activity, particularly in the industrial sectors that require consistent electricity availability. Manufacturing, mining and electricity declined by a collective 6.1% in the fourth quarter.

“The outturn was worse than our expectation of a 0.4% quarter on quarter contraction as well as Bloomberg’s consensus of a 0.5% quarter on quarter contraction. The contraction was broad-based, with all goods-producing sectors relapsing, underscoring the severe impact of intensified load shedding in the corresponding quarter,” says FNB senior economist Thanda Sithole.

The country’s biggest sector, finance, contracted in the fourth quarter. The finance, real estate and business services industry, which contributes nearly 24% to GDP, shrank by 2.3% subtracting 0.6 percentage points from GDP in the quarter.

Lehohla says the dominance of the financial sector indicates there is something terribly wrong in our economic fundamentals. He says this equates de-investment in crucial sectors that can actually grow jobs, such as manufacturing:

“Once you shift your productive assets into financial then you are in trouble, you are de-investing in manufacturing. It is a problem. Then we say the world is moving towards the financial sector, no. It is not. People still need to eat, they don’t eat financials. This nonsensical idea that money is the most important thing causes such damage to the economy and poverty and all the resources go to the one percenter’s because of financialisation and leave the 99% outside that bubble,” he said.

READ: Manufacturing nosedives because of increased load shedding and low activity

Other sectors, which recorded the biggest declines, included the trade, catering and accommodation industry, which dropped by 2.1%. Mining and quarrying decreased by 3.2% on the back of reduced activity for diamonds, iron ore and platinum group metals. While the agricultural sector was down by 3.3% contributing a dip of 0.1 of a percentage point each to growth.

Sithole says growth is forecast to come in at sub-one percent this year before gradually recovering to 1.4% in 2024 and 1.6% in 2025.

“Should intensified load-shedding persist, surpassing what is currently envisaged in our baseline throughout first half of the year, a prolonged recession will be likely.”

Publications

Publications

Partners

Partners