The loyalty industry is growing in leaps and bounds in South Africa after the explosion of more retailers offering these in the last four years, and more consumers are taking these up to either save or get money back to help with increases for basic necessities.

The loyalty industry refers to store cards that bulge our wallets, from the likes of Clicks, Pick n Pay, Checkers and other big retailers and banks, that we use to save a buck, get petrol or get cash back.

As consumers have been faced with increasing costs for their basic needs, the use of these cards or programmes has climbed from 67% in 2015 to 73% in 2022.

Amanda Cromhout, the founder and head of loyalty consultancy group Truth, says:

READ: 2.1 million families go hungry as food inflation hammers the poor

She said loyalty programmes were gaining in popularity in the country because most consumers were cash-strapped and needed access to funds. Eighty-eight percent of households whose income is less than R10 000 per month are especially dependent on these programmes.

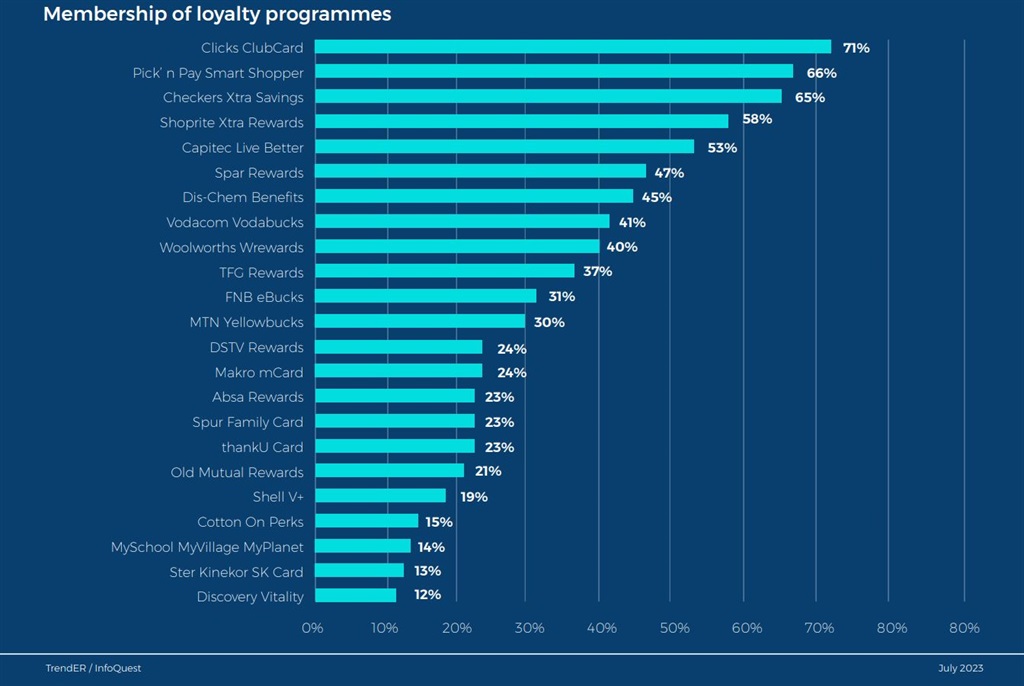

A survey conducted by TrendER/infoQuest, a leading South African online research company, found that consumers between the ages of 35–49 belonged to at least 10 programmes, while the youth aged between 18–24 belonged to the least loyalty programmes at seven.

Cromhout says approximately 70% of the big retailer’s turnover is through their loyalty programme.

She says Clicks has the most popular loyalty programme as 80% of the company’s revenue is through their Clicks loyalty card.

Clicks is the number one most-used loyalty programme in the country after running their programme now for about 26 years.

"They have been able to offer consistent value back for their customers, whether it's points, discounts or offers through their club cards. I’ve observed their programme, they have a solid loyalty offering and have been doing so for the long term. Followed by Pick n Pay, Checkers and Dis-Chem."

READ: No rate hike respite even as consumer inflation is set to dip back below 6%

Cromhout, who just bagged an international industry award, says these programmes help with brand loyalty and more companies are now improving their offering while retailers who don’t have these will now be keen to invest in these.

"[Retailers are looking at how they can better create a relationship with their customers so they can understand their customer base better and create value and help their wallets go further."

Most notable is the increased participation of men who’ve now seen the light post the outbreak of the Covid-19 pandemic. She adds:

Cromhout says consumers should consolidate their spending to get the most out of these rewards.

"Choose one to three brands that really make sense to you and focus on spending in those brands because then you’ll get better rewards and maximum benefits. Consumers lose out if they spend everywhere because then they can't consolidate their rewards."

Publications

Publications

Partners

Partners