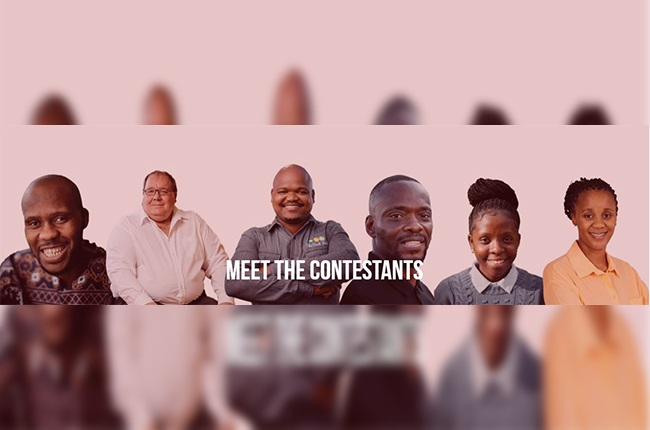

Follow six ordinary South Africans as they take up the Absa/City Press Money Makeover Challenge and undergo a money makeover boot camp.

The next six months will test their resolve and make them face tough decisions on every aspect of their finances. Each candidate has been allocated their own Absa financial adviser who will assist them in organising their finances and reaching their personal financial goals.

The candidates will be required to complete certain financial tasks and stick to the budgets set out for them to win incentive prizes or be selected as the final winner. Personal finance expert Maya Fisher-French will be sharing their stories with you and hopefully inspire you to start your own money journey

Johan: Settling debt before retirement

Johan, who is visually impaired, is in his late fifties and, like many people approaching their 60th birthday, he is worried about his finances in retirement.

“I need to settle my debts and increase my retirement funds as I only have seven years left to work before retirement,” says Johan, whose wife is expecting to retire in the next four years.

Their children are financially independent, but the couple has accumulated significant debt and the repayments take up the bulk of Johan’s salary, with his wife’s salary covering the day-to-day expenses.

This makes it challenging for Johan to boost his retirement funds and clear his debt by retirement.

My big dream:

“To be debt free as soon as possible.”

READ: Do you want to have a healthy relationship with money?

My worst financial mistake:

“Borrowing against our home loan and, when the home loan was fully paid, spending money on my credit cards.”

The six-month plan:

- Become debt free before retirement

- Have an emergency fund

- Proper estate planning

- Retire financially healthy

His adviser:

Takalani Badugela is a certified financial planner at Absa, with more than eight years’ experience. She provides clients with advice across various financial pillars: debt, risk, investment, taxation and banking reviews.

She was awarded the Top Investment Award for three consecutive years.

“My wish is for Johan to have peace of mind, knowing that his financial woes are being dealt with and will end. I am excited to work with him; he is really keen to turn his financial life around.”

Mlibokazi: Tackling family debt

Mlibokazi is in her early thirties and works at a financial institution. Many of her peers who work in the financial industry will empathise with her challenges.

Having access to preferential loans, Mlibokazi faced pressure from her family to borrow funds to help them.

“I did a lot of things for family in the Eastern Cape. I used debt to cover the costs and had three major events that required money quickly. I would get a favourable interest rate, but I didn’t realise how much it was. I am drowning; it creeps up on you,” she admits.

Another challenge is that Mlibokazi and her husband do not discuss their finances and she has never discussed her financial situation and family obligations with him.

My big dream:

“To live a life in which I don’t have financial strain and do not worry about money.”

My worst financial mistake:

Taking on so much debt, especially in such a short period of time.

READ: Personal Finance | Do you have money regrets?

The six-month plan:

- Draw up a combined family budget

- Create a debt repayment plan

- Start saving for emergencies

- Start monthly contributions towards a retirement annuity

Her adviser:

Khathutshelo Ravele has been working as a certified financial planner for seven years.

She loves her job as she works with people and makes a difference in their lives.

“My wish for Mlibokazi is for her to have the financial literacy that will give her the confidence to tackle the financial challenges she currently faces, as well as manage her finances in the future.”

Molefi: Financial independence by 45

Big data administrator Molefi is 32 years old and aims to be financially independent at 45. For him, financial independence means being able to start his own consultancy.

However, he has other life goals between now and then, which could hinder his goals if he does not plan for them properly.

He would like to buy a home in the suburbs of Cape Town, which, at current property prices, will require a significant deposit. He also has plans to marry and would like to be able to provide for his wife. “I want to be in a strong financial position to provide my future children with a different upbringing to what I had.”

My big dream:

“To have my own businesses in the tech space, which will not only bring innovative solutions among the youth, but develop tech giants.”

My worst financial mistake:

“I got caught in an investment scam that involved investing in commodities from China.”

The six-month plan:

- Start building up capital in a separate portfolio to fund his wedding

- Start saving to build his home after he is married

- Revisit his budget and make sure that he is able to stick to it while completing his PhD

- Consider purchasing furniture, as he is currently renting it

- Create a plan to be financially ready to start his own company in ten years’ time

READ: The benefits of having and managing your budget for the year ahead

His adviser:

Mcebisi Ndaba is a virtual financial adviser at Absa, with a BCom in finance. He has worked as a financial adviser for nearly 15 years.

He is passionate about assisting clients with building sustainable financial futures and wealth, through a holistic financial planning approach.

“Molefi is an ideal young professional client as he is still starting out on his journey into financial independence and his career.

“He has no debts whatsoever, which is impressive for his age.

“Over the next six months, we plan to refine his budget and create plans to reach his goals.”

Raymond: Food entrepreneur

Raymond is in his early thirties and has a small restaurant in the Ngwelezane township near Empangeni, KwaZulu-Natal.

He has a passion and flair for food, creating mouth-watering meals, but has been struggling to make the restaurant financially viable. “I need business assistance on how to generate more revenue and how to manage the business cash flow.”

Raymond is the father of two children and the breadwinner of the family.

Like so many young South Africans, he has struggled to find work and his only way of providing for his family is to be an entrepreneur and create his own income, which he does through his restaurant and farming.

But it takes skill and knowledge to run a successful business – something that young South Africans are not taught at school.

My big dream:

“To own a professional fast food restaurant with the aim of providing job opportunities and being successful.”

My worst financial mistake:

“Not saving for emergencies and spending more than I earn because of too many personal needs.”

The goals:

- Separate finances between personal, restaurant and farm

- Consider various funding options to install electricity and purchase a delivery scooter

- Improve business management skills

His adviser:

Jacoline de Villiers has been a financial adviser for eight years and finds great joy in helping clients feel at ease about their finances.

“I would like Raymond to succeed in his dream and get the financial freedom he deserves through gaining enough knowledge and skills to become a successful business owner.”

“Ultimately, the farming business must supply the restaurant and himself with food and, in turn, the restaurant should generate enough income to support his family comfortably.”

Sello: Start-up in manufacturing

Sello is in his early forties and established a start-up with the aim of manufacturing eco-friendly straws for restaurants and retailers. He took out personal loans to start the business, which is not yet generating an income as Sello is still in the process of producing the prototype. So far, he has been funding the small steps of his business from his salary. His goal over the next six months is to produce his first prototypes and business plan so that he can apply for funding from the Industrial Development Corporation.

His focus now is to find a small warehouse where he can move his two machines to and where his two part-time employees can operate them to produce the prototypes.

“Using my salary to fund the business is not helping me move fast because I have kids in school, a home loan, car finance and other family financial responsibilities, including servicing the loans I took.”

My big dream:

“To successfully launch this business, stabilise it and grow it so that one day I will work in it with my employees.”

My worst financial mistake:

“Purchasing a vehicle in 2008 while I was on a three-year employment contract, thinking I was going to find another job. I did not and started defaulting on my car repayments after the contract ended, and I got a judgment against my name for five years.”

The six-month plan:

- To create a business plan to apply for funding

- Settle smaller debts to improve his credit score before applying for a loan

- A proper household budget to find additional funds to settle the debt

- A review of his life cover and estate planning

His adviser:

Philander Tshivhenga has been a financial adviser for seven years and loves working with people to assist them with their financial needs through holistic financial planning. “I would love to see Sello receive the funding he needs for his business. His energy and enthusiasm and his willingness to learn will make him conquer. He is such a goal-driven man and knows and understands where he wants to see his business go.”

Zihle: Job starter and supporting family

Zipho-Zihle is just 26 years old and supports both her sisters after her mother passed away nearly three years ago. Her youngest sister is completing matric this year and the older one has just graduated from university but is struggling to find work in Gqeberha, in the Eastern Cape.

Her mom passed away soon after Zihle started working, leaving her as the sole breadwinner. Zihle has taken on debt to keep paying the bills.

“I thought I could fix it with time, by taking out a small loan at first, but then the debt just got bigger and bigger. I am tired of the constant worry and fear of not being able to provide for myself and my family. I would like to find a way to repay my debt and still be able to afford my basic needs.”

My big dream : “To have financial freedom to work on my dreams, such as studying and starting my own business.”

My worst financial mistake:

“Accumulating debt at a young age and not saving. That resulted in debt dependency, and it threatens my financial security.”

The goals:

- To find additional money in her budget to reduce her debt

- To finalise her mother’s estate and transfer the property into the three sisters’ names

- Review her insurances to improve cover at a lower cost

- Start saving towards her retirement

- Draft a last will and testament

Her adviser:

Anton Battiss joined Absa as a financial adviser after qualifying as an attorney. He decided to go into financial advisory rather than practise law because he wanted to help people achieve their financial goals. “Nothing makes me happier than when a client tells me they feel more at ease after speaking to me; like a weight has been lifted off their shoulders.”

His wish for Zihle is for her to become financially healthy. “She is a young professional and should be able to enjoy the fruits of her hard work and studies.”

City Press will follow the candidates’ progress on the first and third week of each month, as well as online on the MoneyMakeover page:

You can follow the story on social media #CPMoneyMakeover

- Facebook: @CPMoneyMakeover

- Twitter: @CPMoneyMakeover

| ||||||||||||||||||||||||||||||

|

Publications

Publications

Partners

Partners