It is often said that active unit trust managers struggle to outperform their more passive counterparts, but there are more aspects that should be considered.

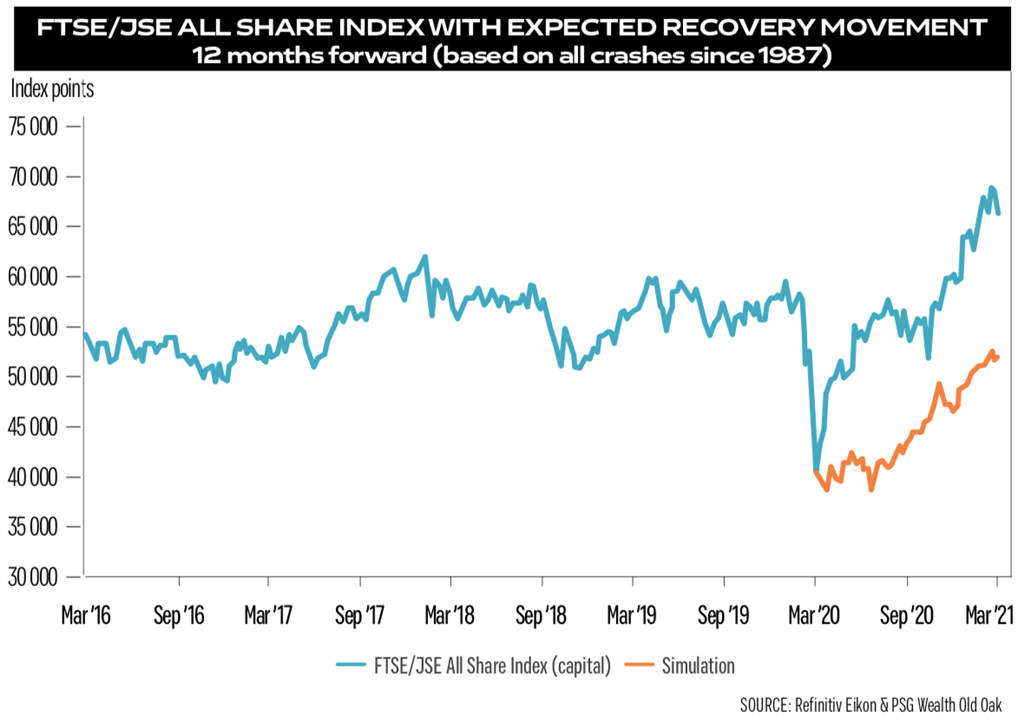

Just more than a year ago, South Africa moved into the Covid-19 lockdown. But it’s not just one year since the commencement of lockdown, it also marks the low point (reached on 19 March 2020) when the FTSE/JSE All Share Index (JSE) had declined by 39% from its previous peak in January 2018.

This was also the lowest point at which the JSE had traded since April 2013. And little did we know at the time what a rollercoaster ride the next year would bring.

When you look at the JSE from a historical perspective, you will see that it only contracted by 30% or more from its peak on five occasions since 1987.

When you compare the returns for the 12 months that followed the four previous contractions (excluding the 2020 correction) to the return we have seen over the last 12 months, you will understand why experts are astonished.

Yes, on all four prior occasions the 30% contraction point was the worst time to withdraw your investments, but the last 12 months’ recovery has been just phenomenal by historical standards.

All of this may still be fresh in our minds, but we are still not out of the woods and the last 12 months were not easy.

Over the last year several experts in the investment industry, along with several media platforms, were quick to point out how active unit trust managers struggled to outperform their more passive counterparts, and this criticism is not necessarily unfounded.

Let us use all SA general equity unit trust funds with a current fund size of R1bn or more: Until 19 March 2020, only 35% of these funds were able

to outperform the JSE’s average return for the six preceding 12-month rolling periods since19 March 2014. This was such a difficult time for these funds that for the 12-month period ending 19 March 2018, no SA general equity unit trust fund could outperform the JSE at all.

And it is during these times that the spotlight often falls on active managers’ normally higher cost structures compared with those of the more passively-managed exchange- traded funds (ETFs).

A well-diversified portfolio should include both active and passive investment strategies, and this is especially so during difficult times like we experienced over the past 12 months.

More than half of all SA general equity unit trust funds with a fund value of R1bn or more did not just manage to outperform the JSE’s 54% recovery, but they notched up an average return of 81% over this period, according to data from Refinitiv Eikon.

I have no doubt that several passive fund supporters will regard my data as biased, but I assure you that this is not the case. As I mentioned before, there certainly is a place for good passive funds in most investment portfolios.

But what I would like to point out, is that contrary to ETFs, which aim to deliver a lower cost and lower tracking ratio option, most active managers aim to manage not only investors’ investment growth, but also their risk.

Make sure that when you do your investment homework, you don’t just look at the price of the investment you are interested in, but also at the risk-adjusted historical returns. The last thing you want is for the saying, “buy cheap, buy twice” to apply to you.

Publications

Publications

Partners

Partners