From payments processors, payroll suppliers and online retailers to art houses: How SA businesses coped in the darkest days of the pandemic.

Covid-19 has not only impaired lives, but business continuity too.

Around the world, businesses – from small to the largest of conglomerates – have had to grapple with how to keep operations running while maintaining social distancing and adhering to national lockdown restrictions, to limit the spread of the coronavirus.

A crisis of this nature and magnitude placed enormous pressure on organisations to quickly adapt or cease to operate, either briefly or indefinitely.

How quickly a business harnessed the technology it was already employing within the organisation, or digitally transformed its operations, was what kept most enterprises from losing huge chunks of their productivity and output.

Processing mobile payments

Yoco was primarily built on easing the use of cash in the economy by taking cash transactions digital and at low cost. Some seven out of ten adults in South Africa have bank cards, according to Katlego Maphai, co-founder and CEO of Yoco. But, the challenge in the country lies in the ability to accept card payments, which is costly for small businesses.

On 15 March (incidentally the Ides of March), when President Cyril Ramaphosa encouraged social distancing, it effectively signalled the start of a new reality. Maphai and his team immediately started working from home on 16 March and began forecasting probable scenarios of how transactions could take a knock from social distancing and the upcoming national lockdown. “We knew transaction volumes were going to plummet,” he says.

Transaction volumes

Maphai says as businesses began to understand that they could make applications to government to be declared an essential service and trade, Yoco started to see transaction volumes steadily pick up towards the end of level 5. When level 4 kicked in, transaction volumes began to rise above 25%.

As the payments provider to over 80 000 small businesses, Yoco had a direct overview of how hard entrepreneurs were hit by the pandemic through the use of a small business turnover index. The index tracks the total amount of money small businesses are making on sales through their card machines or online payments. Overall, transactions rose by 60% during lockdown level 4 and had increased by 84% at the end of June.

According to Maphai, the small business monitor also worked as a tool to provide entrepreneurs with insight into how well or poorly they were doing in comparison with peers, as it also showed how transaction volumes were impacted in different industries. “It drove the entrepreneur to think of a change in strategy in response to a changing environment,” he says.

Employee payments

Payroll software company SimplePay helps businesses manage and streamline the process of making payments to employees, automating processes such as calculating payments, withholding tax and depositing monthly payments into designated bank accounts of employees.

"The nature of our product, payroll software, means that we are a crucial link enabling employers to avail themselves of the various government schemes to try and stay afloat during lockdown," says Dave Ungerer, managing director of SimplePay.

Due to the lockdown, in early April SimplePay decided to put other plans on hold in order to give such aspects their full attention and ensure that these processes were, and continue to be, as smooth as possible for clients.

In terms of keeping abreast of what clients need in order to complete registrations, submissions and claims, the biggest challenge by far, according to Ungerer, has been the inconsistency of the government systems, particularly around the Covid-19 Temporary Employer- Employee Relief Scheme (TERS) claims. For example, the export file to complete TERS claims required many iterations in a truly short space of time due to changes in the government specification.

“This pandemic has clearly posed a tough tech challenge and learning challenge for all, the government included. We realise the government is also operating under difficult circumstances. There has been definite improvement since April, but we and our clients are still struggling with some inconsistency in the UIF systems,” he explains.

Ungerer says costs have remained relatively unchanged because, being a software development company, tech has always formed the centre of their operations. “We did, however, do some cost-cutting in terms of making our use of certain services and tools (such as our servers) more streamlined and efficient.

“We are also able to help cut costs for our clients because our system and its functionality is available anywhere with an internet connection and browser. There is no need to be in an office or on a specific company network, as with some other packages,” says Ungerer.

Bidding from home

The coronavirus pandemic also led to widespread closures of art galleries, art fairs, and live auctions, with sales from Christie’s, Phillips, and Sotheby’s falling 87%, according to London-based art market research firm ArtTactic’s survey. “Economic uncertainty, coupled with the art market’s inability to function as normal, has thrown the art market into the unknown,” states the report.

“When Covid-19 regulations forced us to postpone the sale from 30 March, we were expecting to proceed as usual in May and looked forward to the cocktail preview, viewings, walkabouts and other events, culminating in the sale at the Vineyard Hotel saleroom,” says Frank Kilbourn, chairperson of Strauss & Co.

“It soon became clear that it was not to be and we faced a choice: cancel the sale or find a different way to proceed,” he says, adding that “the prospect of having to arrange a virtual live auction for the first time was daunting”.

The auction house enlisted the help of invaluable.com, which specialises in online auctions, to reach new audiences internationally while also having to adjust its current online technology and bidding practises to align with that of invaluable.com.

Kilbourn says that “while it worked very well, there were some teething problems”. For instance, there were prospective bidders who had trouble getting into the website, registering, following the sale, or placing bids.

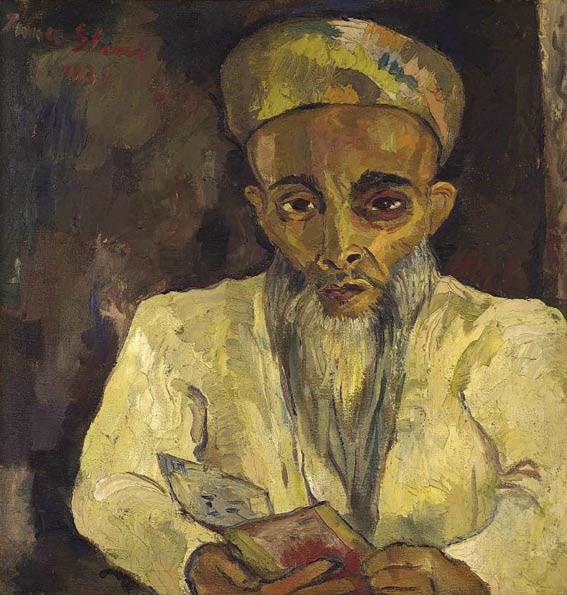

Held over two days with auctioneers leading the live- streamed sale from studios set up in Cape Town and Johannesburg, the nearly 650-lot sale earned R79m with a lot sell-through rate of 77.34%, according to the auction house. Irma Stern’s painting Still Life with Lilies achieved the highest price and was sold to a telephone bidder for R14.8m, while the artist’s oil-on-canvas Zanzibar Arab sold for R11.4m, also to a telephone buyer.

According to Bina Genovese, managing director at Strauss & Co., old and new ways of trading converged in the virtual sale, with elite buyers frequently opting for live telephone bidding despite the seamless bid logging offered through invaluable.com’s platform.

With art fair season upon us, one of the country’s most anticipated, the RMB Turbine Art Fair, said they are also going virtual in August because of the coronavirus pandemic. “Due to Covid-19 and lockdown safety precautions across the country, a physical fair is not possible. But a fair is most definitely required to offer support and a platform for galleries and artists alike,” says Glynis Hyslop, founder of the fair.

Each gallery will have a dedicated virtual viewing room where they will display their artworks with interactive messaging, according to Hyslop, with behind-the-scenes profiling of artists, and video. Visitors to the virtual RMB fair will be able to search artist, exhibitor, or medium.

Hyslop says some of the technological challenges anticipated with going virtual include data and internet access that may be a challenge for some of the audiences, however, “we are working towards making the fair as accessible as possible for audiences with fast and efficient loading times”.

More products offered

Unlike anything the world has seen before, the pandemic fuelled a sudden digital surge that catapulted both global and local e-commerce traffic to unprecedented levels, says Matthew Leighton, spokesperson for OneDayOnly.co.za.

“As an online sales company, we felt the impact almost immediately after the announcement of lockdown in March. Our focus needed to shift from our normal sales tack of offering customers an assortment of discounted deals, to a very specific range of products such as PPE [personal protective equipment], sanitisers and essentials items,” Laurian Venter, director of OneDayOnly, tells finweek.

She says the e-retailer also noticed a marked increase of customers, as many people abandoned traditional shopping in favour of purchasing their essentials and other goods online. “They were looking for safe and convenient deliveries to their front door,” she says.

However, such unprecedented growth was not without a challenge. “We needed to radically rework our customer communications to ensure we could keep an increased number of customers informed and updated on the whereabouts of their order. Our warehouse systems needed to be adjusted to account for the drastic increase in goods, especially at the time e-commerce reopened. Several processes were redesigned to increase scalability,” she says, admitting that “it has been a frantic time.”

Publications

Publications

Partners

Partners