The old way of looking at asset management decisions are changing. The use of data is boosting this revolution.

The world of investment is changing rapidly. A combination of Covid-19, lockdowns, fiscal stimulus packages, higher savings, and more leisure time has caused a surge in retail investing. Online investment platforms like eToro, Robinhood and EasyEquities now not only make it easier for ordinary people to invest in global stocks, but also allow amateur traders to build up an international reputation and following.

Dave Portnoy, better known as Davey Day Trader, is at the vanguard of a movement to upset the ways of institutional investors – the ‘suits’. This democratisation of investment arguably threatens the livelihoods of investment companies and their asset managers.

Asset managers are fighting back with better technology. In almost all sectors of the economy, better technology means greater efficiency; yet many new technologies in the investment world have been blamed for higher volatility, illiquidity and inefficiency. The reason for this is big data and ever-growing computing power are changing the nature of financial analysis. Old-school investment practices in which investors carefully comb through company financial reports and business models have, over the last decade, given way to analyses that focus more on the trading activity of other investors, also called ‘investor demand data’.

Sophisticated algorithms now help traders engage in statistical arbitrage where they search for profit-making opportunities from others’ poor decisions. This approach relies on the identification and persistence of systematic mispricing because of psychological, as opposed to, fundamental factors.

Think of it this way: Fundamental data is valuable as it tells us how markets should price assets (normative approach); it allows investors to predict future cash flow and asset prices. Investor demand data contains no fundamental information. It instead focuses on why prices are where they are now (positive approach) – which may or may not be fundamental-driven.

Yet this approach has proven successful as investors trade against demand shocks, sometimes referred to as searching for ‘dumb money’. By using sophisticated algorithms to combine the decisions of millions of investors, it allows the trader to buy low, sell high and profit, without knowing anything about the firm or its business strategies.

In a new American Economic Review paper, economists Maryam Farboodi and Laura Veldkamp argue that this shift towards demand data arbitrage is happening at a frightening pace and will no doubt affect pricing efficiency. To make their case, they built a model. Their augmented information choice model has three novel features – they not only model a choice between fundamental information and investor demand information (the crux of their story), but also long- run technological progress and long-lived assets, assumptions that have not been combined in a model like this before.

The model allows them to draw certain conclusions. It begins with the fundamental insight that prudent use of available data can reduce risk, but also create it. Stay with me here. More data reduces risk by allowing investors to better forecast asset payoffs. If we can predict more of the payoff, we end up with less risk. But the payoff of an asset also depends on its future price. That price, however, depends on what future investors will know. If future investors have a lot of data, the future price is more informative and thus more sensitive to future innovations in cash generation or product demand. Yet, if future prices are more sensitive to unknown future innovations, they are riskier today.

To sum up: more informed traders in the future make prices react more strongly to new information, which makes future asset values riskier. This is what the authors call future information risk, because the future price of an asset that is less predictable today creates risk. And therein lies the trade-off that more data creates: It could lead to better predictions of the future payoffs, but also expose greater future information risks.

The point is that traders would want both types of information. They want fundamental analysis to make better predictions about future asset prices. Their new methods allow them to extract such fundamental analysis from the decisions of everyone else. But too much of such demand information can also cause volatility, because it creates future information risks, leading to inefficiency and illiquidity.

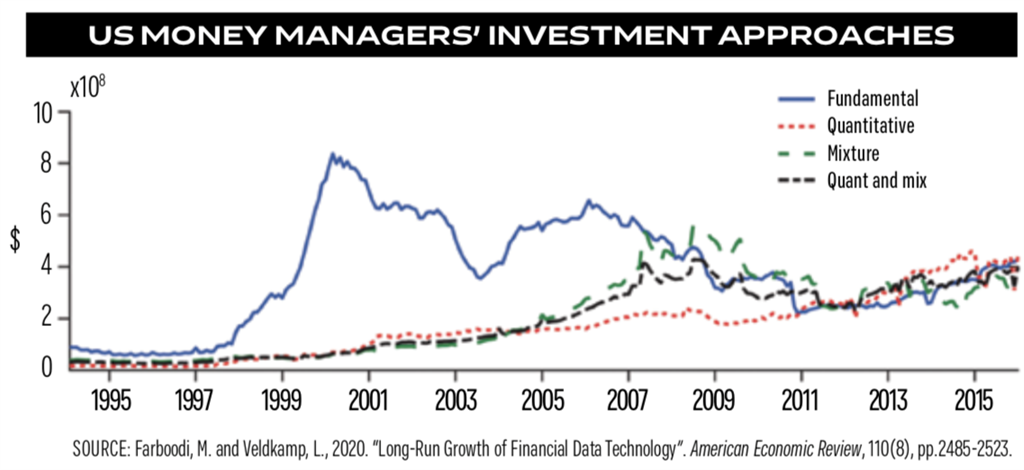

Does this model have any real-world predictive power? One obvious conclusion is that fundamental analysis would decline as technology improves. To show that this is true, they plot how hedge fund assets over the last two decades have shifted away from fundamental analysis to quantitative analysis. In fact, as the accompanying figure demonstrates, fundamental analysis has been replaced by a mixture of quantitative and mixed approaches.

Will this trend continue?

Although the authors make no predictions, I suspect there is little that will stand in its way. As more retail investors join the democratisation of investment, fuelled by personalities like Davey Day Trader, the amount of ‘dumb money’ traded on the world’s leading stock exchanges will likely proliferate. And as big data techniques improve, the sophisticated algorithms that investors use to take advantage of arbitrage opportunities will become more lucrative.

The likely rewards will push traders further away from fundamental analysis and towards demand data analysis.

Publications

Publications

Partners

Partners