Reduced bond payments could prompt homeowners to consider investing. Rather use these savings to pay off your debt, advises Schalk Louw.

They say that you shouldn’t sweat the small things in life, and although there might be a lot of truth to this saying, I think there lies greater truth in the fact that you can be successful if you do the small things right.

Best-selling author James Kerr tried to determine how the New Zealand rugby team (the All Blacks) manages to remain so successful year after year in his book Legacy. One of the things in his findings that made quite an impression on me, was the fact that every player in the All Black team cleaned up the locker room after every game. It doesn’t matter who you are, every team member does his part by sweeping and ensuring that the locker room is left in a better condition than they found it.

Now, you may wonder what this has to do with their success, and the answer is: a lot. It is something as small as that, that gives the team its power. It teaches them discipline and, in general, to be in the service of others. Something as small as that makes a huge difference on the rugby field.

Even considering a good recovery from local and offshore stock markets since March this year, markets remain under pressure in 2020, but many investors are willing to push their fears aside and see the great potential or success this asset class has to offer. Although I also can see great value in shares right now, especially over the long term, many investors also tend to look past the smallest and simplest, yet highly effective, investment of all: personal debt.

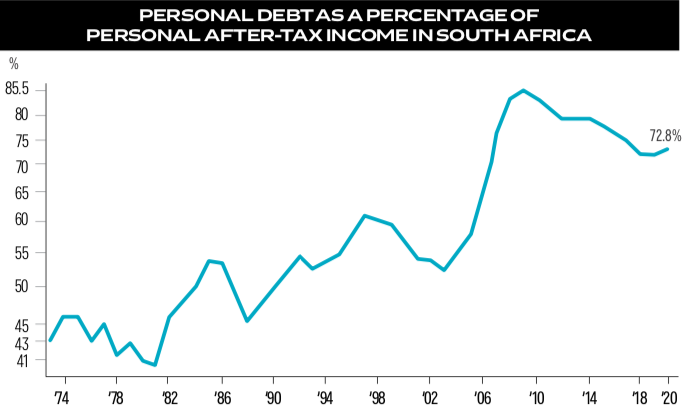

But when I look at personal debt as a percentage of after-tax income in SA, this ratio is troubling, to say the least (see graph).

Several private investors have approached me recently with a need to invest extra capital, but they are unsure about the right investment vehicle to use between endowments, unit trusts, linked products, direct shares or properties.One of the first questions I ask, in context of the broader discussion with the investor, is always: “What is your current debt ratio?”

Always start by saving on your debt. If you had made a 20-year home loan worth R500 000in December 2019 at the prime rate of 10% at that stage, your monthly repayment would have been R4 825. If the prime rate had remained unchanged, you would have made repayments to the value of R579 000 after 10 years. But the reality is that even after making these payments for 10 years, you still would have owed the bank aboutR365 000, which effectively means that you had to pay R579 000 over a period of 10 years to settle only R135 000 on your home loan. The main component of your repayments would have been allocated towards servicing the interest on your home loan.

We all know, however, that SA interest rates have decreased dramatically since the beginning of this year, with our current prime rate now at 7.25%. That means that your monthly repayment on the same 20-year home loan would have decreased to R3 952. So, what should you do? Should you invest this monthly “saving” in an equity-linked investment in the hopes of making a fortune?

Consider this: by being disciplined and sticking to your original repayment of R4 825 per month, you won’t be paying off your home loan over a period of 20 years, but actually in just a few months short of 14 years (if interest rates do not change). In other words, by continuing to pay the extra R873 per month, which you were used to paying and irrespective of the lowered interest rates, you could be completely debt-free roughly six years earlier than you would have been if you paid the lower premium. After you paid off your bond earlier, don’t just increase your lifestyle expenses, invest the full original premium in an investment.

Obviously, there is a time and place for everything, and I would never discourage an investor from investing in shares. What I’m recommending, however, is that you first settle your debt, and then move on to other types of investments.Unlike paintings, the more expensive investment isn’t always the better investment, and many investors have fallen into this trap over the years. Great success often lies in something as simple as paying off a little extra on your home loan, but the secret lies in having the discipline to start today.

Publications

Publications

Partners

Partners