- Delayed decisions on customs duties are costing the fiscus R1.25 billion, a report by XA Global Trade Advisors shows.

- There are 46 tariff and anti-dumping investigations underway, and more than half of these are overdue.

- Most investigations have been completed, they just need to be signed off by ministers.

- Get the biggest business stories emailed to you every weekday or go to the Fin24 front page.

Delayed decisions on import duties and anti-dumping measures are costing the South African fiscus R1.25 billion, a report by XA Global Trade Advisors shows.

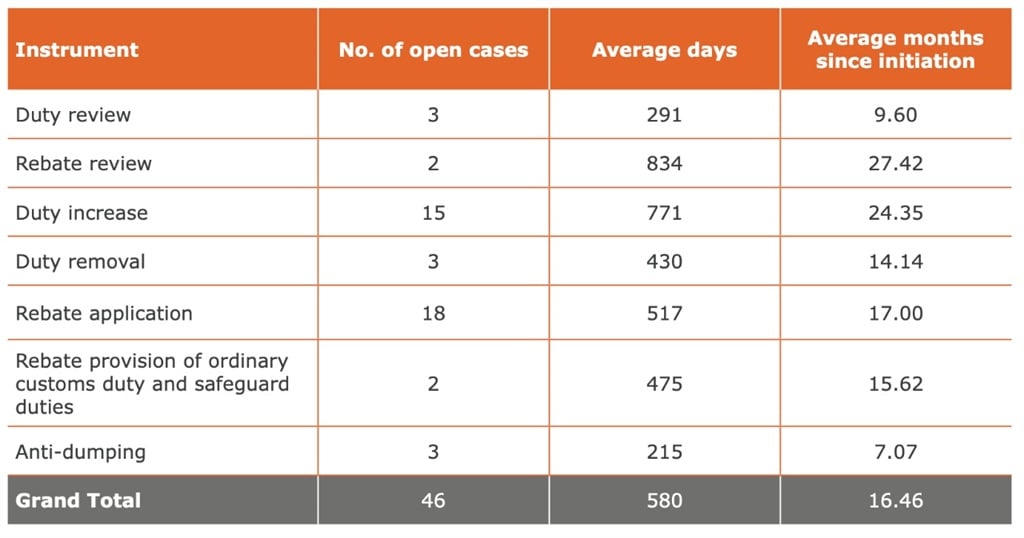

The Open Cases Report, released on Tuesday, is the trade advisory group's first. It considers the timeframes involved by the International Trade Administration Commission (ITAC) in applications submitted to change tariffs or duties on imported products.

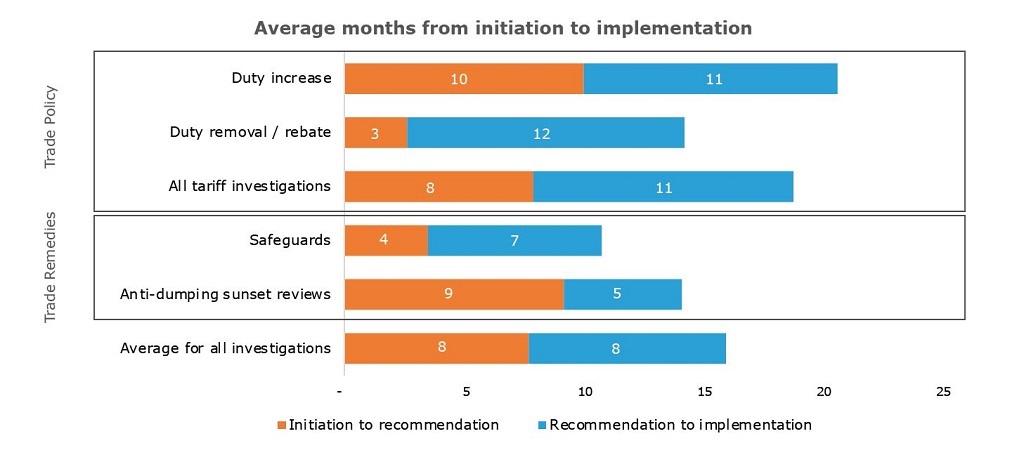

The applications include those for higher duties, anti-dumping duties and safeguard duties. Applications for duty increases, reductions and rebates should be completed within six months, within normal conditions and in four months, for industries in distress.

Investigations for safeguards aimed at remedying a specific problem are reasonably expected to be completed within 18 months, the advisory noted. Similarly, anti-dumping investigations are to be completed within 18 months, or they expire.

However, the tariff-applications - besides anti-dumping applications - run close to two years.

As at 1 July 2022, there were 43 tariff investigations and three anti-dumping investigations which are currently open. More than half (27) are overdue, the report noted.

"The cost of lost revenue due to the delays in finalising the protective actions on time has been R1.25 billion in custom duties not collected by the fiscus," the report read. The advisory explained that if increases had been implemented in time, then R1.25 billion is what would have been collected by the fiscus.

On the flipside, it also notes that a R2 billion cost is imposed on industries for duties collected on goods that are not locally produced.

"In total, South Africa collects around R55 billion per annum in customs duties, so these delays are equivalent to more than 5% of our total customs duty collections," the report read.

XA Global Trade Advisors however, believes these costs can be resolved if overdue cases are finalised. The advisors also argue that the majority of cases have been finalised by ITAC. They just need to be signed off by the ministers of finance, and trade, industry and competition.

"We know that most cases leave ITAC fairly quickly. The bulk of the delay is sitting with one or two ministries," said Donald Mackay, CEO of XA Global Trade Advisors.

Mackay added that localisation efforts are being hampered by "indecision" on duties.

"A key lever to make localisation work is changing duty fees," said Mackay. This includes decisions to remove duties on raw materials to allow local manufacturers to be more competitive.

"I would argue that not taking these decisions. Or taking two years, sometimes three years, to make a decision is harmful to their interest," Mackay added.

If it takes three years to decide on import duties, a local company might not be around in three years' time, he lamented. More so, these delays also impact investor decisions.

*The table reflecting open cases has been updated to reflect the correct total average months. An incorrect version was previously provided.

Publications

Publications

Partners

Partners