- New TransUnion data shows a significant jump in credit card, retail accounts and non-bank personal loans in the latter part of 2022.

- However, the level of unpaid debts is improving.

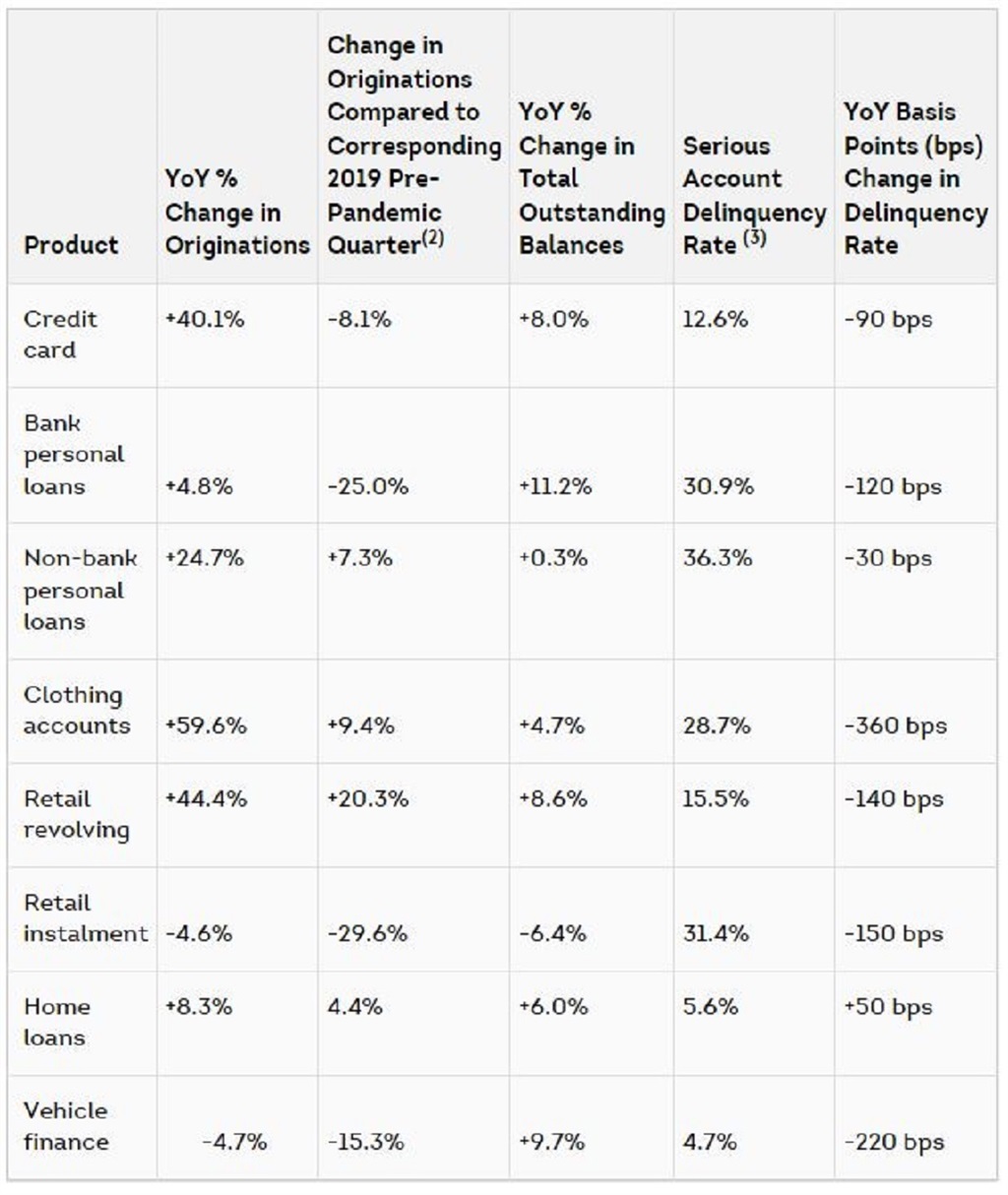

- TransUnion's data shows that credit card origination volumes in the country remained 8% below pre-pandemic levels.

- For more financial news, go to the News24 Business front page.

There has been a sharp increase in demand for credit cards and clothing accounts, with younger and those with weaker credit scores fuelling the surge.

But despite the strong credit demand and aggressive interest rate hikes, unpaid accounts have improved, according to the latest data from one of South Africa's biggest credit bureaus, TransUnion.

Consumer-level serious delinquency (unpaid debt of 90 days or more past due) improved by 230 basis points in the past year to 38.5%. "This improvement suggests consumers appear to be better managing their credit repayments, in order to preserve their continued access to the liquidity that credit products provide as they anticipate continued tough macroeconomic conditions," TransUnion said.

New credit card accounts (originations) jumped by more than 40% year-on-year in the last quarter of 2022, while new clothing accounts rocketed by 60%, TransUnion said.

TransUnion said credit card originations have now been growing for seven consecutive quarters, with the average balance per credit card also rose 7% year-on-year to just over R22 000.

Consumers with subprime credit scores (below 656) contributed more than two-thirds of new cards issued in the last quarter of 2022.

"The higher proportion of riskier originations suggests that younger consumers, particularly Gen Z and millennials (born 1980-1994), who accounted for 64.9% of new card volumes in the fourth quarter of 2022, are driving growth. With growth, potential risks also emerge," wrote TransUnion.

The credit bureau firm added that the increase in average and outstanding balances suggests that some people are relying more heavily on their credit card facilities than before.

READ | Nearly half of SA consumers say their financial position worsened in the past year - report

Still, while reliance on credit cards is increasing, TransUnion's data shows that credit card origination volumes in the country remained 8.1% below pre-pandemic levels.

However, origination volumes for clothing accounts have breached pre-pandemic levels by 9.4%. The jump in volumes was in line with the usual festive season growth.

But almost 90% of all new clothing accounts in December 2022 were for subprime borrowers. Clothing account lenders primarily serve higher-risk consumers and charge higher interest rates for taking that risk.

Retail revolving credit accounts grew by 44% over this period. These volumes were also 20.3% above pre-pandemic levels. Subprime borrowers only made up 60% of new accounts.

Banks were a little more cautious about growing their personal loan portfolios, growing new originations by 4.8% year-on-year. Their loan origination in this area remained 25% below pre-pandemic levels observed in the last quarter of 2019.

But non-bank lenders have grown aggressively. They grew their personal loan originations by 24.7% in the fourth quarter of 2022. This was 7.3% higher than pre-pandemic levels, and loan amounts have now returned to 2019 levels too. Most new loans, 70.1%, went to subprime borrowers at the end of December 2022.

New vehicle loans declined by 4.7% in the last quarter of 2022. Home loan originations still grew by 8.3% despite the interest rate increases.

Publications

Publications

Partners

Partners