- One of Treasury's tasks is to clearly spell out which tradeoffs must be made, and place them at the centre of the country's budget process.

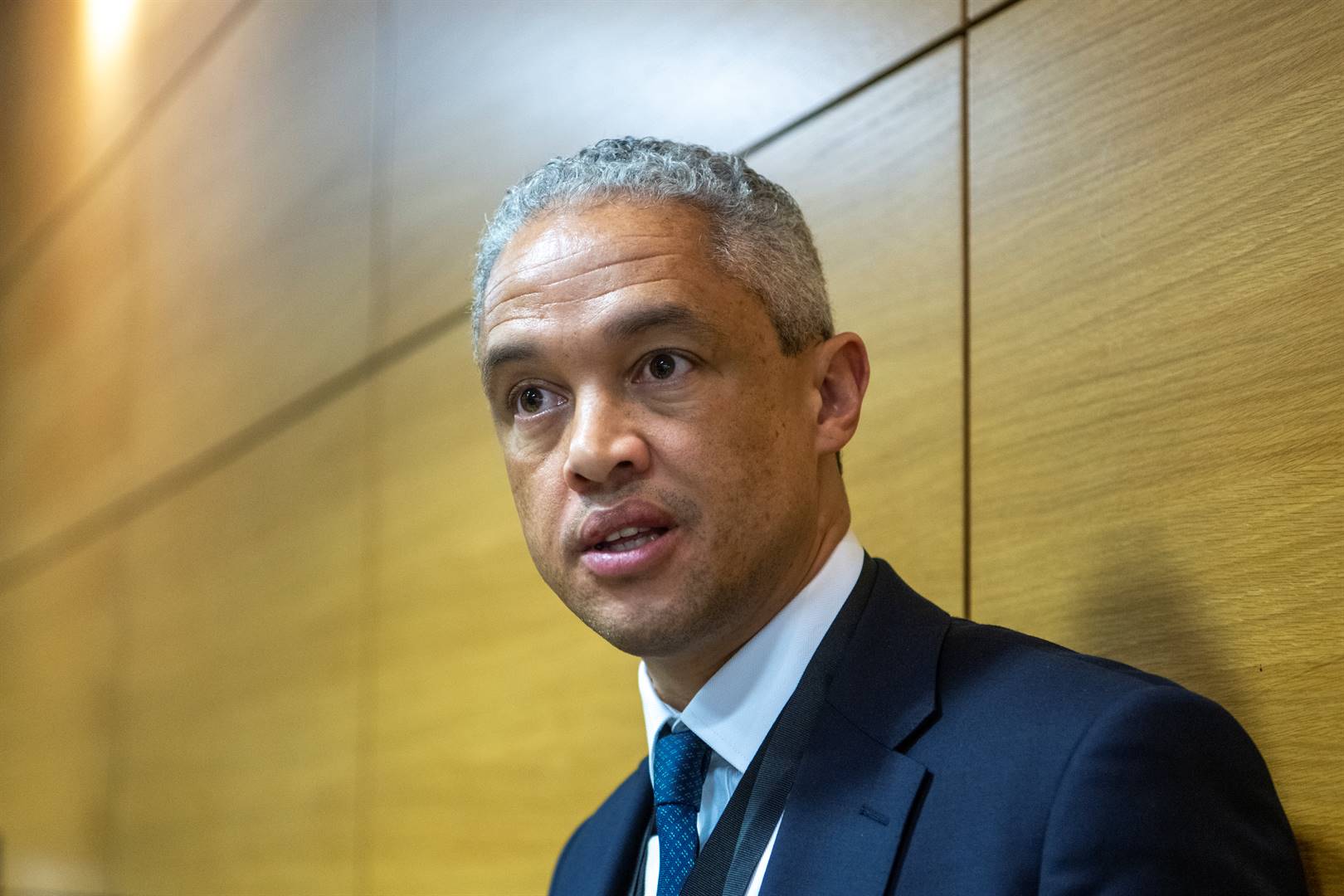

- This is according to new Treasury director-general Duncan Pieterse.

- According to reports, Treasury reportedly suggested to President Cyril Ramaphosa in a meeting about SA's dire fiscal situation, that the R350 grant could be funded by a two-percentage-point increase in VAT or by ending key state programmes.

- For more financial news, go to the News24 Business front page.

National Treasury must ensure that Cabinet clearly understands which tradeoffs must be made, says new director-general Duncan Pieterse.

Pieterse, who was talking to journalists during a South African National Editors' Forum (Sanef) meeting on Tuesday, did not delve into any issues directly related to the upcoming medium-term budget policy statement (MTBPS), nor a recent report by Sunday Times that Treasury told President Cyril Ramaphosa and other ministers government would have to raise VAT or close dozens of state programmes to be able to continue with the R350 social relief of distress grant beyond March next year.

He did, however, say that while he could not go into details about specific tradeoffs, "one of the tasks we have is placing the tradeoffs very starkly and clearly at the centre of the budget process".

"One of our roles is to advise the minister and advise Cabinet on what those tradeoffs are and put it in the clearest terms possible."

He said that if he had to explain it in a conceptual way to ministers, "we are not going to obviously be playing our role as the Treasury - we need to put it in very concrete terms".

"So when we talk about the tax issues, we go into that detail. When we talk about the spending issues, we go into detail around programmes. And when we talk about the balance between the different elements of fiscal policy and how you calibrate fiscal policy to strike the right balance between debt spending and growth, we go into those details."

According to the Sunday Times, Treasury reportedly suggested that the R350 grant could be funded by a two-percentage-point increase in VAT or by ending programmes such as visible policing, the expanded public works programmes, the mine health and safety inspectorate, welfare support and environmental protection, among others.

This was all reportedly discussed at a "secret meeting" with the president about SA's dire fiscal situation, at the Spier Wine Farm last week.

The state's tax income has been hit by lower commodity prices and a weak economy due to record load shedding and sky-high interest rates.

A large public sector wage hike has put more pressure on its budget, while government's borrowing costs have soared due to a range of factors including the country's greylisting and the Lady R diplomatic crisis.

Economists expect South Africa's budget deficit to be much larger than Treasury forecast at the start of 2023.

Pieterse said on Tuesday it was previously announced that Treasury and the Presidency were working together on recommendations they could make to Cabinet about "the reconfiguration of the state".

"What that really is about is identifying the areas in which the state is organised that are no longer fit for purpose. And that includes both the structure of the state, but also includes the various programmes.

"That work has continued, and the outcomes of that work will be announced, either at the MTBPS at the latest, or even sooner."

Pieterse said that from a fiscal framework perspective, there are three tools that could be used – taxes, spending, and debt.

"So to the extent that you don't create the right spending efficiencies … the burden on achieving a sustainable fiscus falls upon the other two pillars of fiscal policy, which is debt, and taxes. So the implication of not dealing with inefficient spending, the implications of not reconfiguring the state, mean that you either have to borrow more, or you have to increase taxes.

"Now, both of those options have their own very difficult and negative consequences in this particular environment where our debt service costs are already much higher than many other parts of our budget, including, for example, the police budget.

"So those are … the broad consequences of not dealing with the required efforts that we need to make to ensure that, in particular, inefficient spending is dealt with."

Publications

Publications

Partners

Partners