The signs may look good, but it's premature to pop the champagne corks, writes Schalk Louw.

- For more financial news, go to the News24 Business front page.

Approaching the year 2000, the Y2K bug provoked global anxiety, with fears of computer systems failing as they mishandled the date change. However, when New Year's Eve arrived, the expected catastrophic events didn't materialise, highlighting the contrast between doomsday predictions and reality.

In April 2022, bearish forecasts warned of an imminent recession and stock-market decline. An October 2022 Reuters poll revealed 65% of economists expected a recession within a year. Yet, the current economic landscape diverges significantly from these predictions.

The US economy is thriving, with unemployment below 4%, falling inflation, strong consumer spending, and a S&P 500 Index surge of over 20% (as of 31 July 2023). Economists (Reuters polls) project a 1.9% GDP growth in the third quarter, far from a recession. Optimistic economists are confident of a soft landing, avoiding a recession and achieving lower inflation.

However, is it premature to uncork the champagne? Is this a potential overreaction, akin to the Y2K bug? Personally, I believe it's not. There are significant indicators pointing towards an impending recession.

The Conference Board's Leading Economic Index (LEI) fell for the 16th straight month in July, marking the longest streak of declines since the lead-up to the 2007 to 2009 recession. The LEI is a measure of economic activity that anticipates future economic growth. The decline in the LEI suggests that the U.S. economy is likely to enter a recession in the near future.

The LEI predicts future economic growth and consists of 10 indicators, including manufacturing production, new orders, building permits, stock prices, and consumer expectations. The yield curve has also inverted, historically a sign of a recession.

Consumer confidence is declining, and retail sales have dropped in recent months.

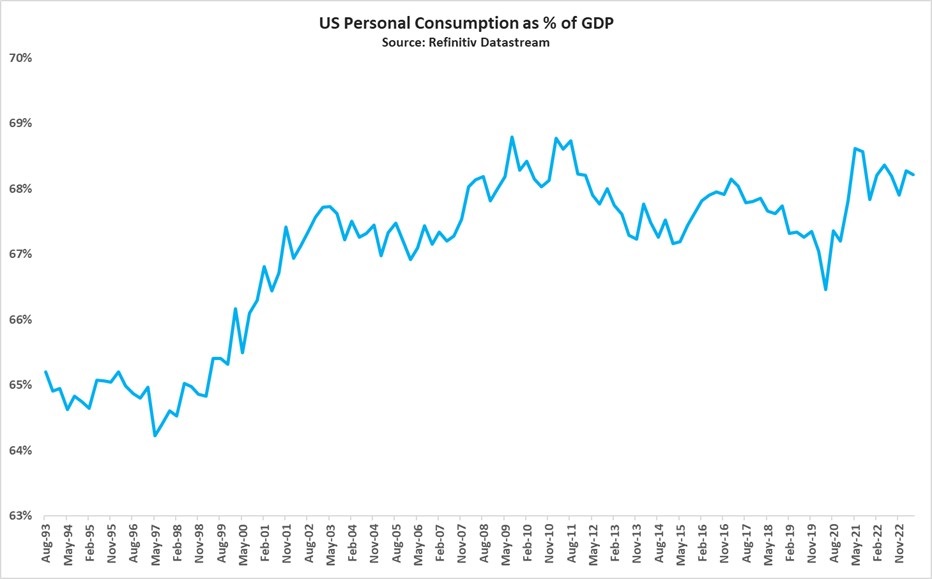

Why is the consumer crucial to the United States? Consumer spending, also known as Personal Consumption Expenditures (PCE), accounts for a substantial 68.2% of the total GDP, a consistent pattern for over two decades.

Understanding that consumer spending makes up more than two-thirds of their economy, this pattern becomes the most pivotal variable in the United States' economic growth and whether a recession looms.

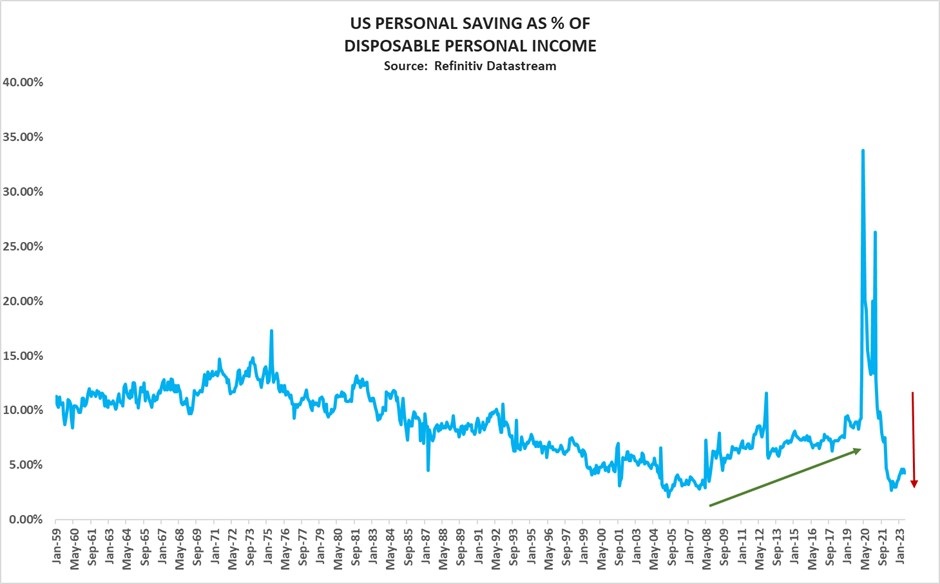

To understand US consumer spending, we must examine the key factors influencing it: savings and debt. After the 2008 World Financial Crisis (WFC), Americans shifted from a spending culture to a saving one. The proportion of disposable income allocated to savings increased from 2.8% in 2007 to 8.3% just before the Covid-19 pandemic.

During the pandemic, households accumulated unprecedented savings due to government stimulus, job losses, and reduced travel and entertainment expenses. Encouraging consumers to spend these savings proved challenging for the Federal Reserve (the Fed). The culture of savings underwent a rapid transformation as the Covid-19 lockdowns lifted, returning to pre-pandemic norms.

Even the increase in the Fed Fund Rate from zero levels in February last year, reaching the current 5.5%, failed to temper this enthusiasm. However, the sustainability of this trend raised questions. How could they consistently outperform expectations and avert a recession?

A recent report from the Economic Research Department at the Federal Reserve Bank of San Francisco highlighted excess savings, peaking at $2.1 trillion in August 2021. Subsequently, household savings have dwindled, averaging a monthly decline of $100 billion. As of March 2023, only $500 billion of excess savings remain, potentially decreasing to as little as $190 billion currently. Several factors drive this reduction, including increased spending, elevated inflation, and rising interest rates. Notably, the music appears to be reaching its final notes, potentially ceasing soon.

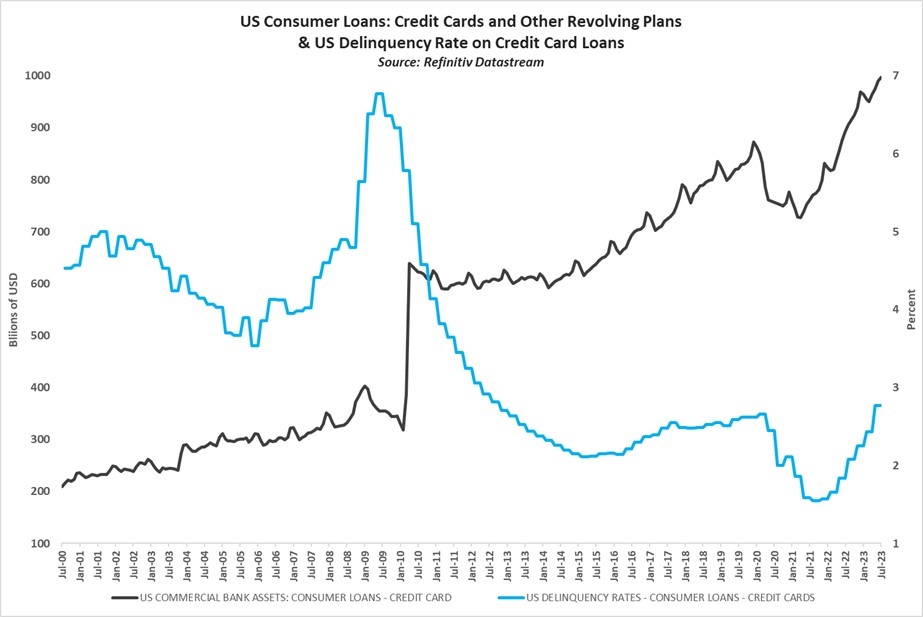

Were savings the sole reason for the economy's resilience, avoiding a recession? Not quite. In addition to a return to a spending culture, US consumers have rekindled their appetite for debt. During the 2008 crisis, credit cards and other revolving plans surged from $300 billion to over $600 billion.

However, with the most recent data release in July 2023, we must note that this debt has surged to $997 billion, and with the August 2023 release, it will likely cross the $1 trillion mark for the first time ever. In other words, the US consumer did not cease spending with the interest rate increases. Rather, they used their savings to continue spending. For those who depleted their savings, this posed no problem, as credit cards were employed to facilitate spending.

So, what happens when savings are depleted, and credit card debt can no longer be serviced, especially as delinquency rates rise?

Do I therefore think the US is out of the woods in terms of running into a recession? I don’t think so.

A more pertinent question arises: do I believe this data will prompt the Fed to exercise caution in raising interest rates further and potentially commence a reduction earlier than anticipated? The likelihood is considerable.

If such a scenario unfolds, we may witness an intriguing landscape in 2024, with the prospect of a risk-on environment returning to the broader financial markets shortly thereafter. As a result, I'm inclined to maintain a cautious stance in the interim, particularly concerning overvalued US equities, given their dependence on the US consumer.

Schalk Louw is a portfolio manager and strategist at PSG Wealth Old Oak.

News24 encourages freedom of speech and the expression of diverse views. The views of columnists published on News24 are therefore their own and do not necessarily represent the views of News24.

Publications

Publications

Partners

Partners