As consumers become increasingly stretched, their options are to either increase their income or decrease their debt.

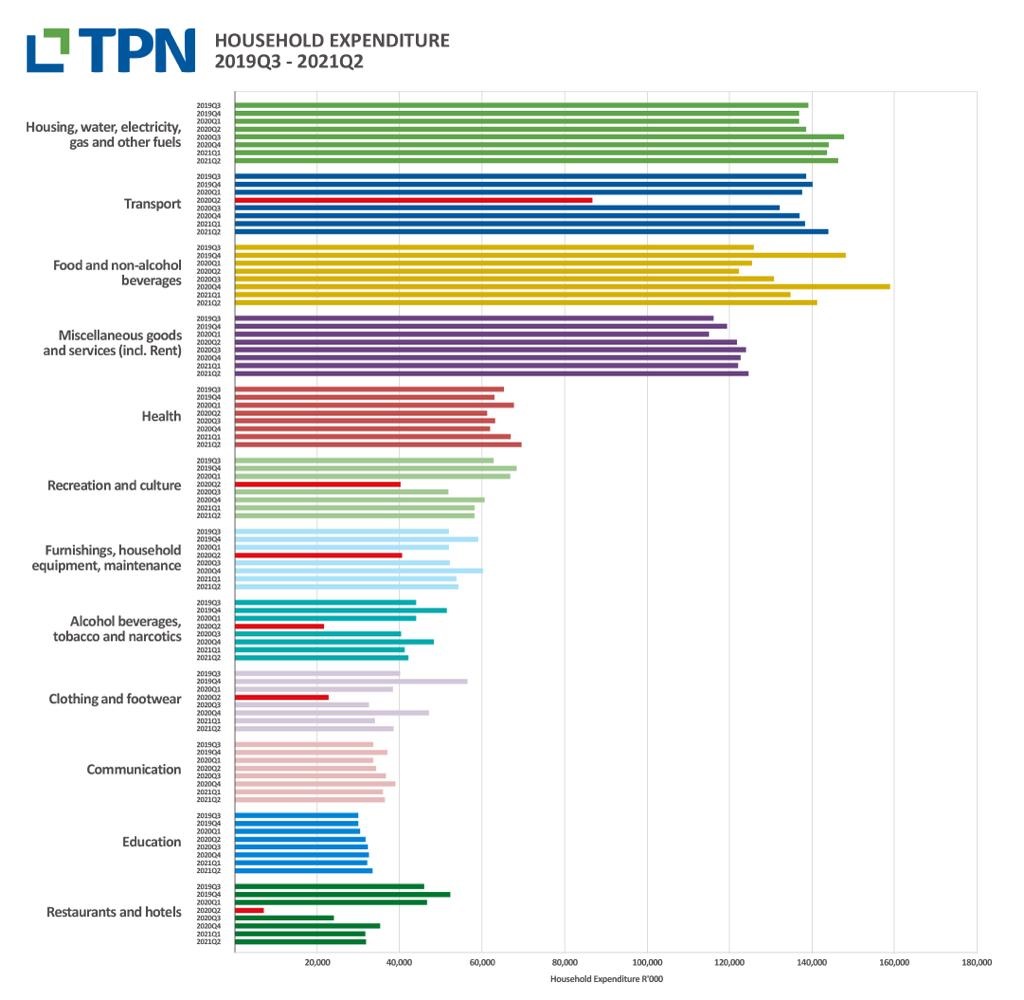

After swiping for housing, transport, food and health care costs, a whopping 68% of your salary is spent. That leaves 32% of our income to juggle on recreation, furniture, alcohol and tobacco, clothing and footwear, communication, education and restaurants – in that order of priority.

Barring transport costs, the hard-lockdown and its various subsequent levels had little impact on consumer spending on essential housing, food or health care items. Communication and education spend remained unscathed by the various levels of lockdown. However, consumers did reduce expenditure at restaurants as well as on alcohol and tobacco, and despite the relaxing of regulations, spending on these items has not recovered.

Access to credit has become a lifeline to ease the stretch between pay-days as consumers allocate 66.7% of their disposable income to debt. Although this is only slightly higher than pre-lockdown levels of 63.8%, the concern is that as the end of the low interest rate cycle creeps closer, the inevitable debt service costs will rise and consumers will have to rebalance their personal budget to make provision for increased interest payments.

The South African Reserve Bank forecasts the repo rate to nearly double in the next two years, that is an extra three percentage points on your current rate. Expect small and steady interest rate increases but start to adjust your current spending to prepare for higher interest rates.

The debate over good credit versus bad credit is ageless. Inherently, consumers appreciate that debt to build wealth through property is considered good debt as mortgage repayments are prioritised higher than any other debt repayment.

Nearly R1tr a month is spent paying down home loans. Only 4% of mortgages – accounting for 66 510 homes – are six or more months in arrears and at risk of repossession. Quick sell or open market sales will nearly always deliver a better price than a repossessed auction sale. Ultimately, any shortfall between the outstanding bond due and sale price will become due and payable by the seller. The objective of the seller is therefore to minimise the effect of any shortfall by optimising the best market price for the distressed property.

Secure debt includes vehicle finance and furniture loans. Car finance accounts for the majority of secure debt by value while furniture loans account for higher volume but smaller value loans.

Only 4.5% of the value of secure loans is in severe six months or more in arrears. But the smaller value furniture loan book tells the scary story of 20% of the number of accounts more than six months behind, that’s 726 996 severely delinquent accounts.

A total of 25m credit cards, garage cards and store cards are used as a stopgap between pay days for consumption spending. Only 70% of cards are meeting the minimum monthly balance repayment. Currently, 4m cards are six or more months in arrears which is a clear indication that consumers are juggling cards.

As consumers become increasingly stretched, their options are to either increase their income or decrease their debt. Practically, a detailed assessment of monthly expenses, cost of credit and better debt utilisation is required.

One option to gain control over credit exposure is to identify those credit agreements with high interest rates and pay them down as quickly as possible. An alternative is to sort by smallest balance due and settle those first, cancel the card and divert the funds used to settle that account onto the next account. Selling the asset and downscaling in the short term often frees up a big chunk of cash.

As 2021 enters the final countdown towards December, if you are fortunate enough to receive a bonus, consider paying down your debt to welcome in the New Year in a financially fitter position.

Publications

Publications

Partners

Partners